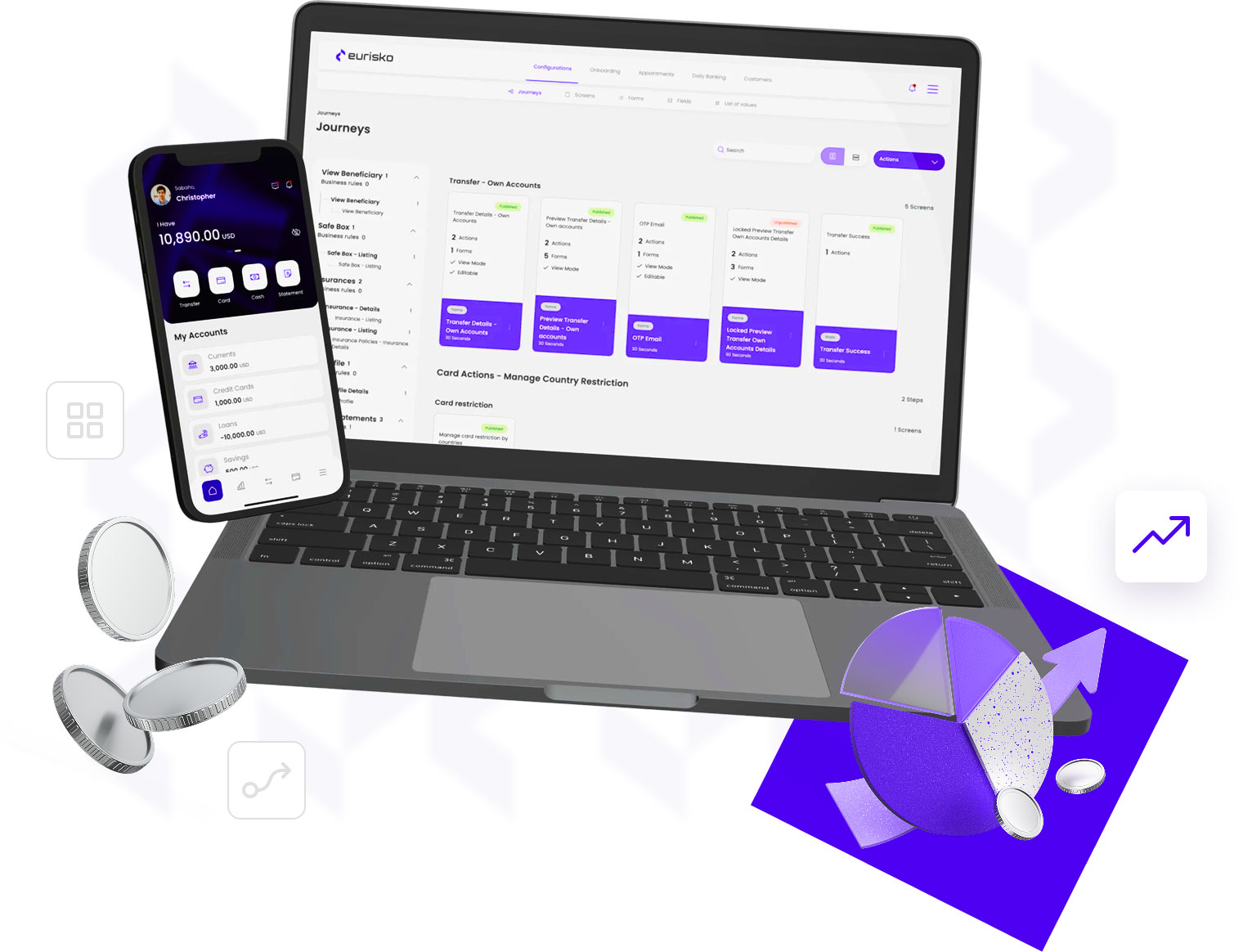

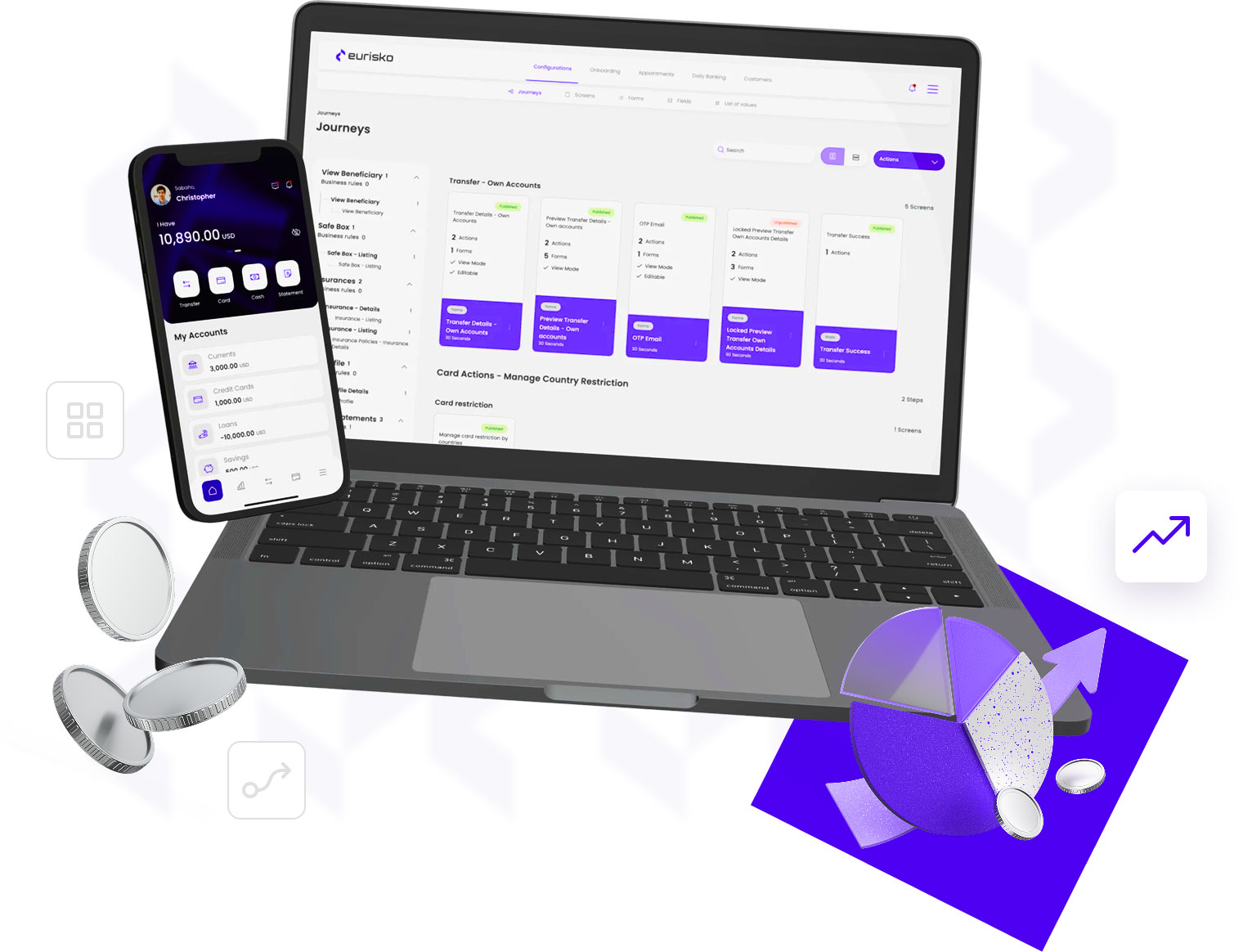

The Composable Digital Banking Platform Built for Control

Eurisko DXP is a composable, AI-native digital banking platform built for banks that demand speed, autonomy, and full control.

Cloud-native yet fully deployable on-premise, Eurisko DXP adapts to any infrastructure, from private data centers to public cloud, while meeting strict regional data-residency and regulatory requirements.

With a modular architecture and end-to-end configurability, it empowers banks to design, launch, and manage digital experiences across Retail, SME, and Corporate banking, all while maintaining full ownership of their data, IP, and digital roadmap.

The Composable Digital Banking Platform Built for Control

Eurisko DXP is a composable, AI-native digital banking platform built for banks that demand speed, autonomy, and full control.

Cloud-native yet fully deployable on-premise, Eurisko DXP adapts to any infrastructure, from private data centers to public cloud, while meeting strict regional data-residency and regulatory requirements.

With a modular architecture and end-to-end configurability, it empowers banks to design, launch, and manage digital experiences across Retail, SME, and Corporate banking, all while maintaining full ownership of their data, IP, and digital roadmap.

Industry Pain Points in Digital Banking

When implementing a Digital Banking Platform, banks today face critical obstacles that slow innovation and limit growth:

Engineered for Intelligent Banking

Eurisko DXP provides a future-ready AI infrastructure that enables banks to introduce new AI use cases quickly and without reworking their systems.

This built-in readiness accelerates innovation, strengthens operational efficiency, and allows financial institutions to deliver smarter, more intuitive, and more adaptive digital experiences at scale.

| Category | Traditional Platforms | In-House Development | Eurisko Hybrid Model |

|---|---|---|---|

| Time to Market | Slow rollout; long delivery cycles | Very long build cycles (12–36 months) | 4× faster time-to-market using accelerators and co-build teams |

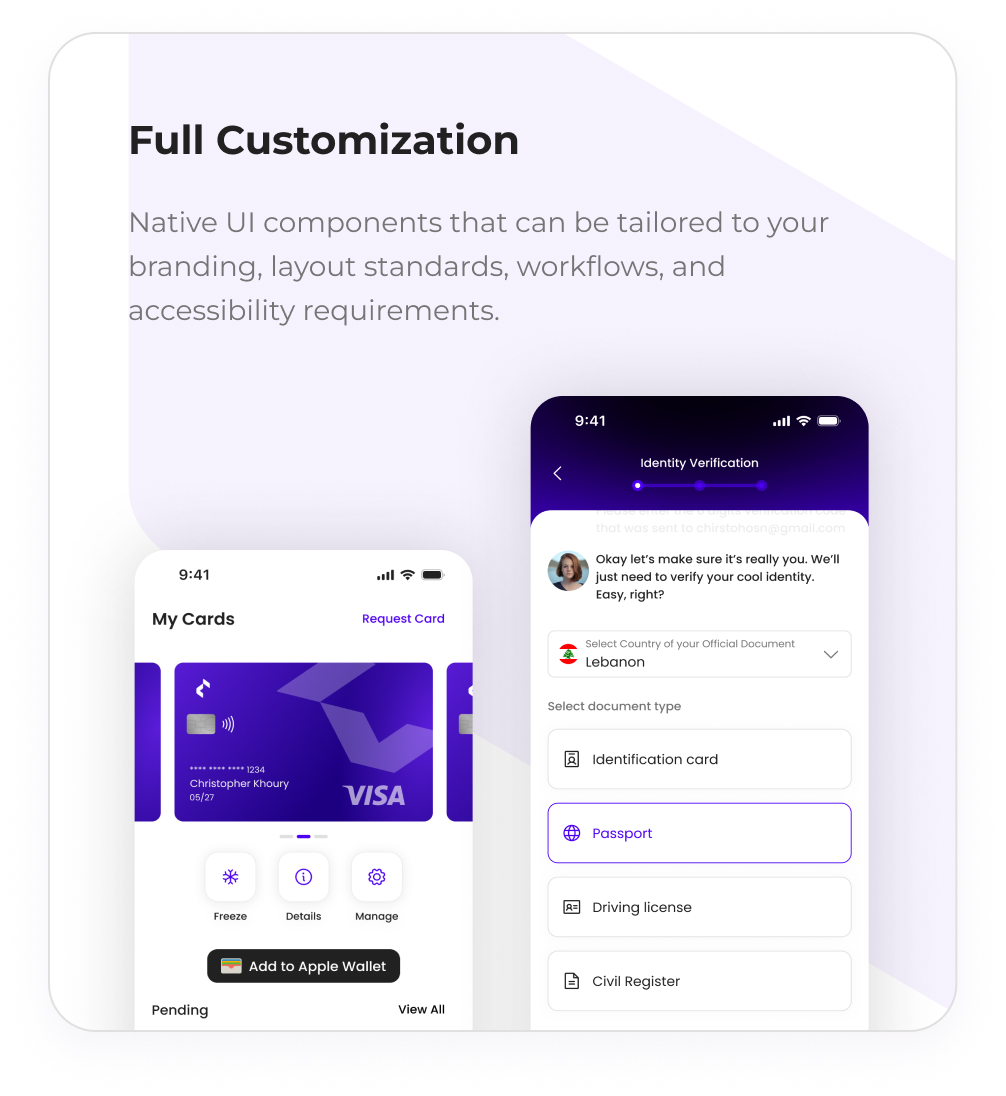

| Customization & Flexibility | Limited customization; rigid journeys | Fully customizable but slow and resource-heavy | Composable, modular, and fully customizable without delays |

| Control & Ownership | Vendor controls roadmap and features | Full control, but costly and talent-dependent | Full ownership of IP, flows, rules, content, and APIs |

| Architecture & Scalability | Monolithic; difficult to evolve | Scalable only with highly specialized internal teams | Composable microservices architecture built for scale |

| Infrastructure | Locked to specific stacks | Requires significant internal DevOps investment | Infrastructure-agnostic: cloud, hybrid, or on-prem deployment |

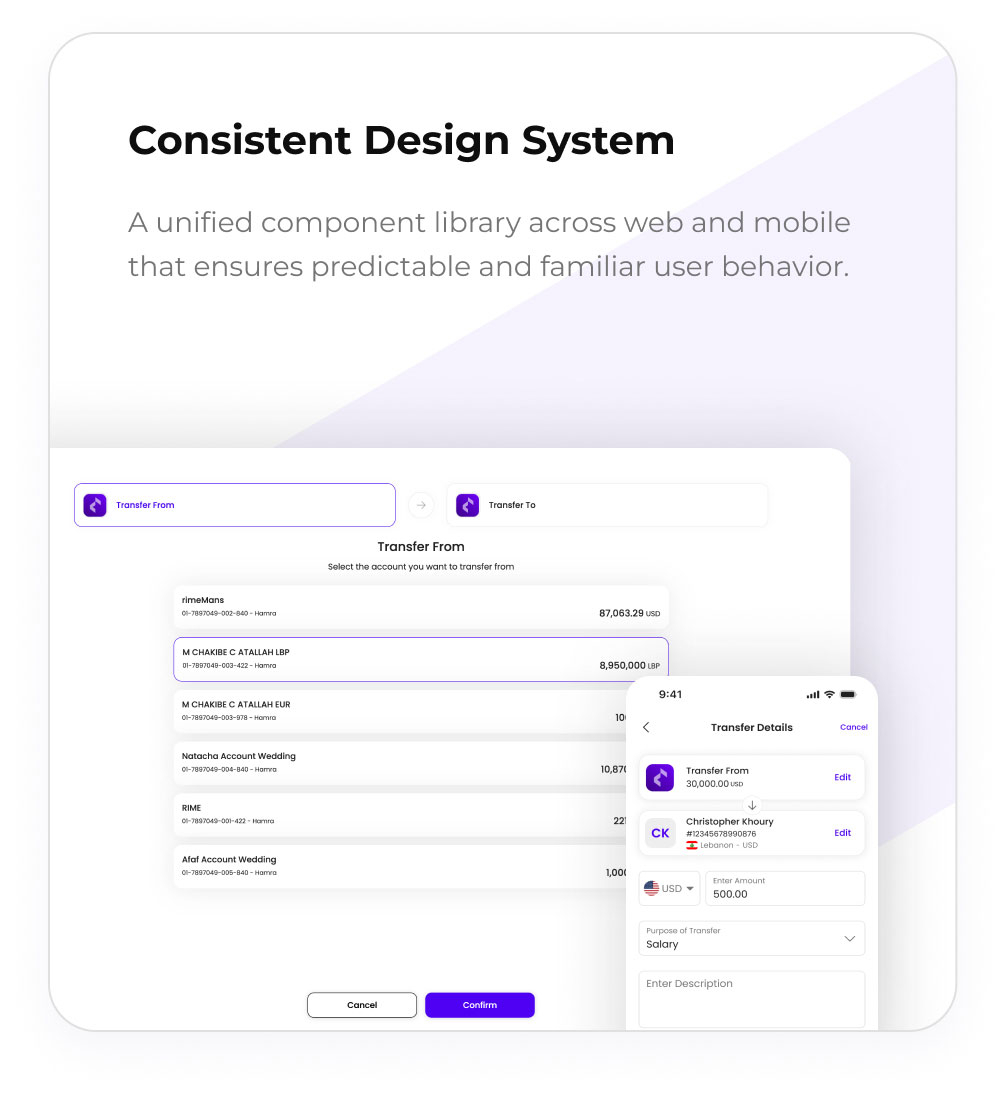

| UX & Interface Quality | Outdated, generic, inconsistent experiences | Quality depends on internal team maturity | Modern, unified UX optimized for Retail, SME, and Corporate |

| Innovation Speed | Dependent on vendor release cycles | Limited by internal bandwidth and talent | AI-native foundation enabling rapid experimentation and feature rollout |

| Cost Efficiency | Lower upfront but high long-term vendor cost | Extremely expensive and resource-heavy | More cost-effective than in-house, more agile than boxed platforms |

| Maintenance & Autonomy | Vendor-dependent for updates and changes | High maintenance burden on internal teams | Bank evolves and manages the platform independently after handover |

The Eurisko Hybrid Advantage

Discovery Phase

We define business requirements, compliance needs, customer journeys, and the bank’s strategic roadmap to ensure full alignment before development begins.

Assemble

We build and prioritize the backlog, define the delivery waves, and set the sequence of high-impact journeys using Agile methodology.

Co-build

Eurisko & your bank’s teams design and develop journeys together, ensuring transparency, real-time knowledge transfer, and zero vendor dependency

Deploy

Automated pipelines accelerate releases, improve quality, and ensure consistent delivery across mobile and web channels.

Transfer of Knowledge

Training, documentation, and hands-on collaboration give internal teams the autonomy to extend, enhance, and manage the platform independently.

Own

The bank owns the journey flows, business rules, API layer, and digital roadmap; which ensures full control, long-term independence, and freedom from vendor lock-in.

Key Benefits of Eurisko DXP

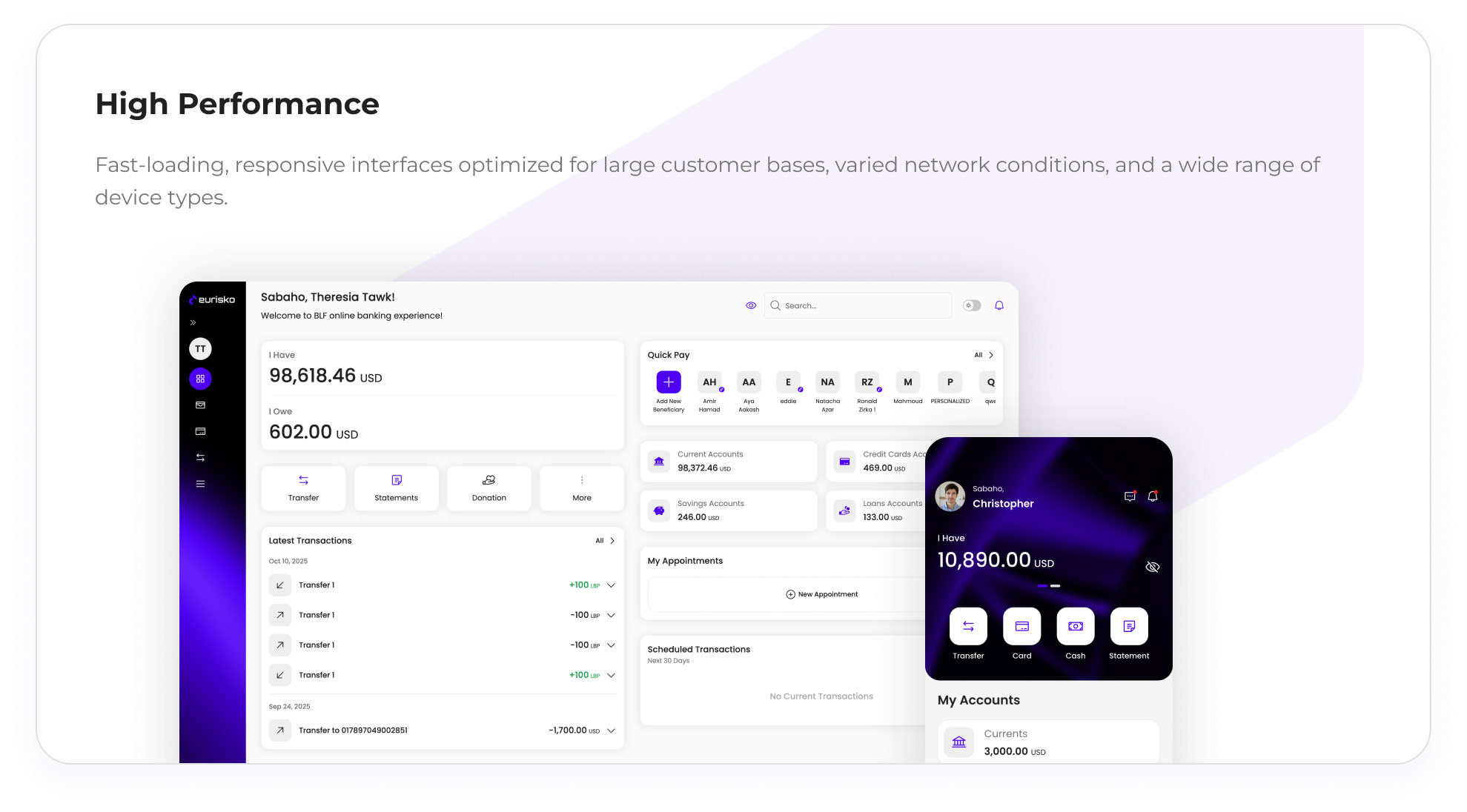

Banks today need a model that balances speed, ownership, and differentiation.

Faster Time-to-Market

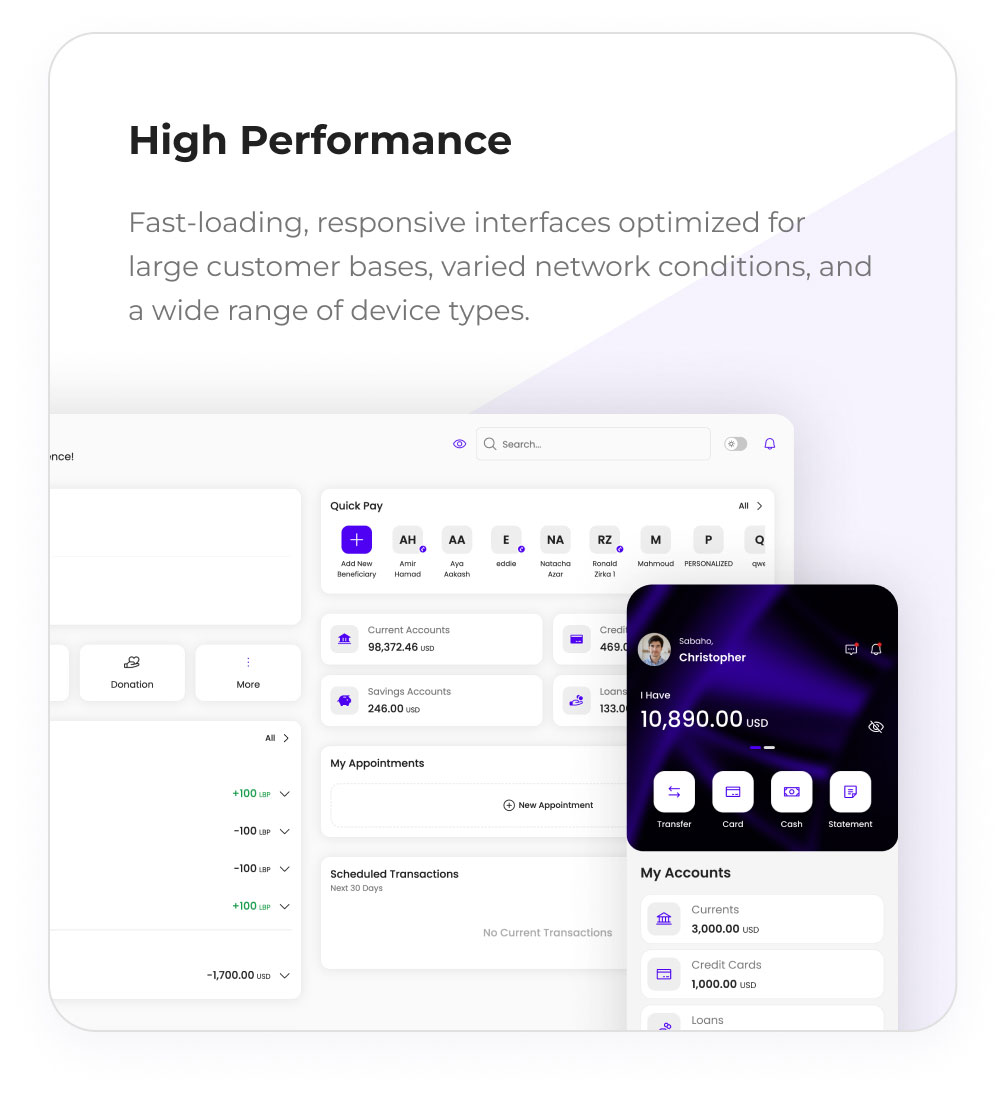

Launch new digital banking journeys in weeks instead of months. Accelerate product rollout across Retail, SME, and Corporate channels with a composable, accelerator-driven foundation.

Full Ownership and Control

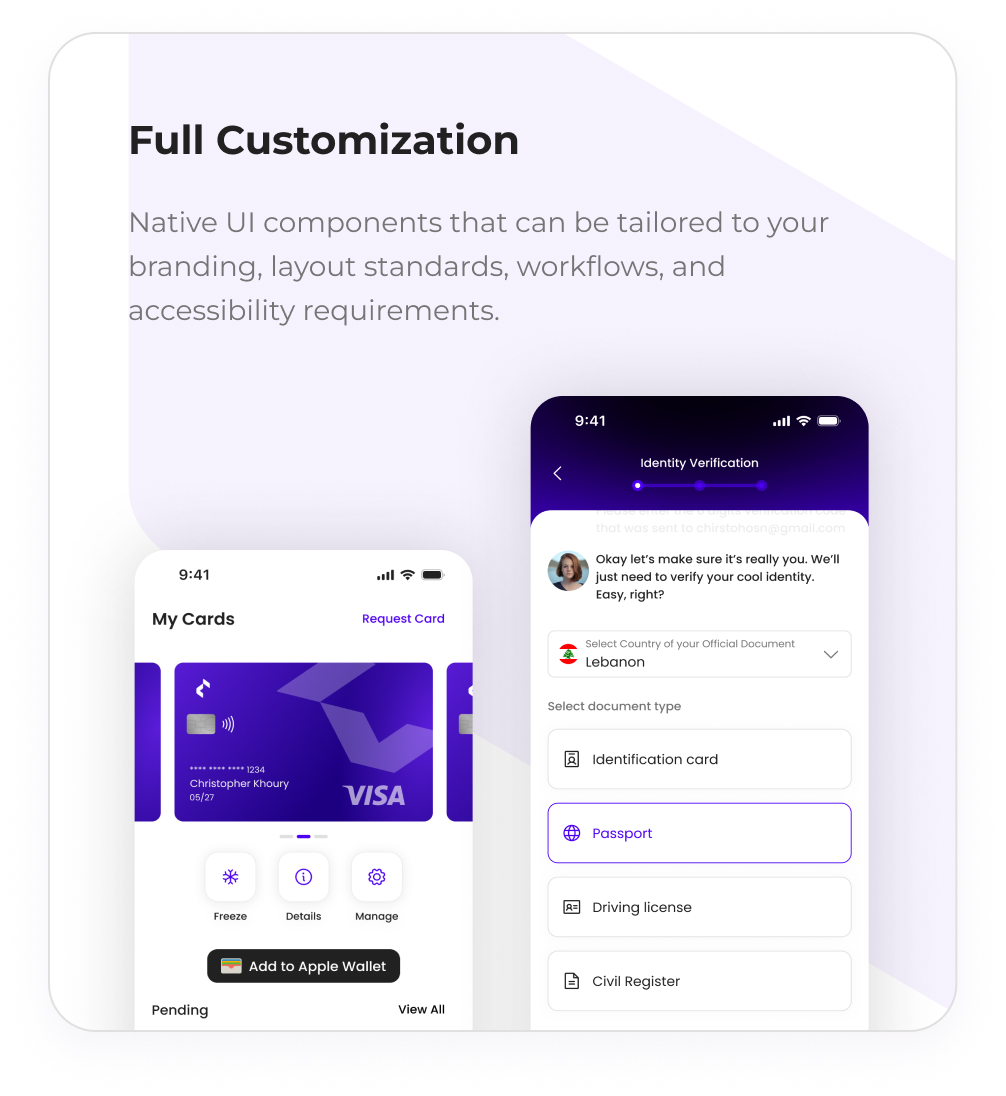

Manage journeys, business rules, content, UI components, and APIs independently, without relying on external vendors. Your team retains complete autonomy over every aspect of the digital experience.

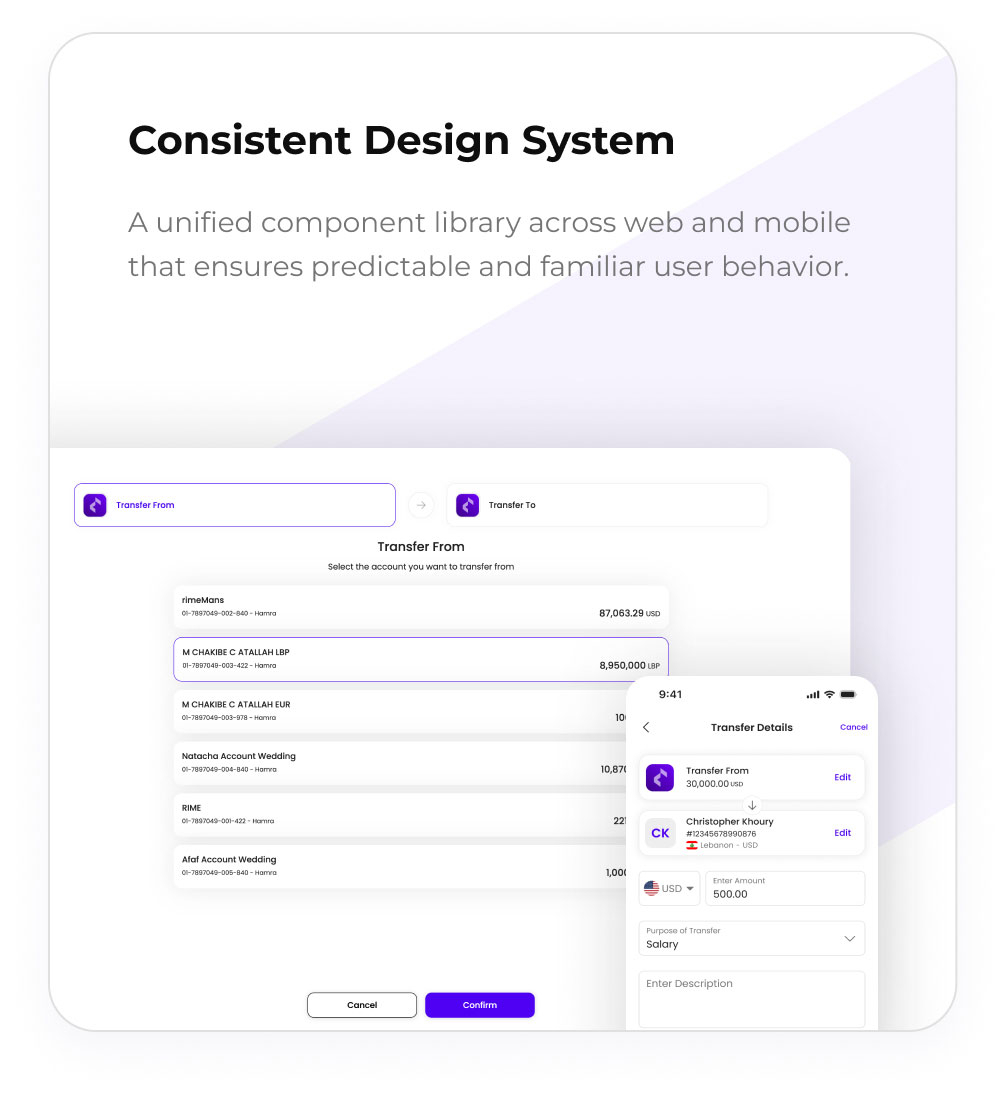

Composable and Modular Architecture

Build once and reuse across all banking segments. Scale rapidly, launch new features faster, and evolve your digital channels continuously with a microservices-based, future-proof architecture.

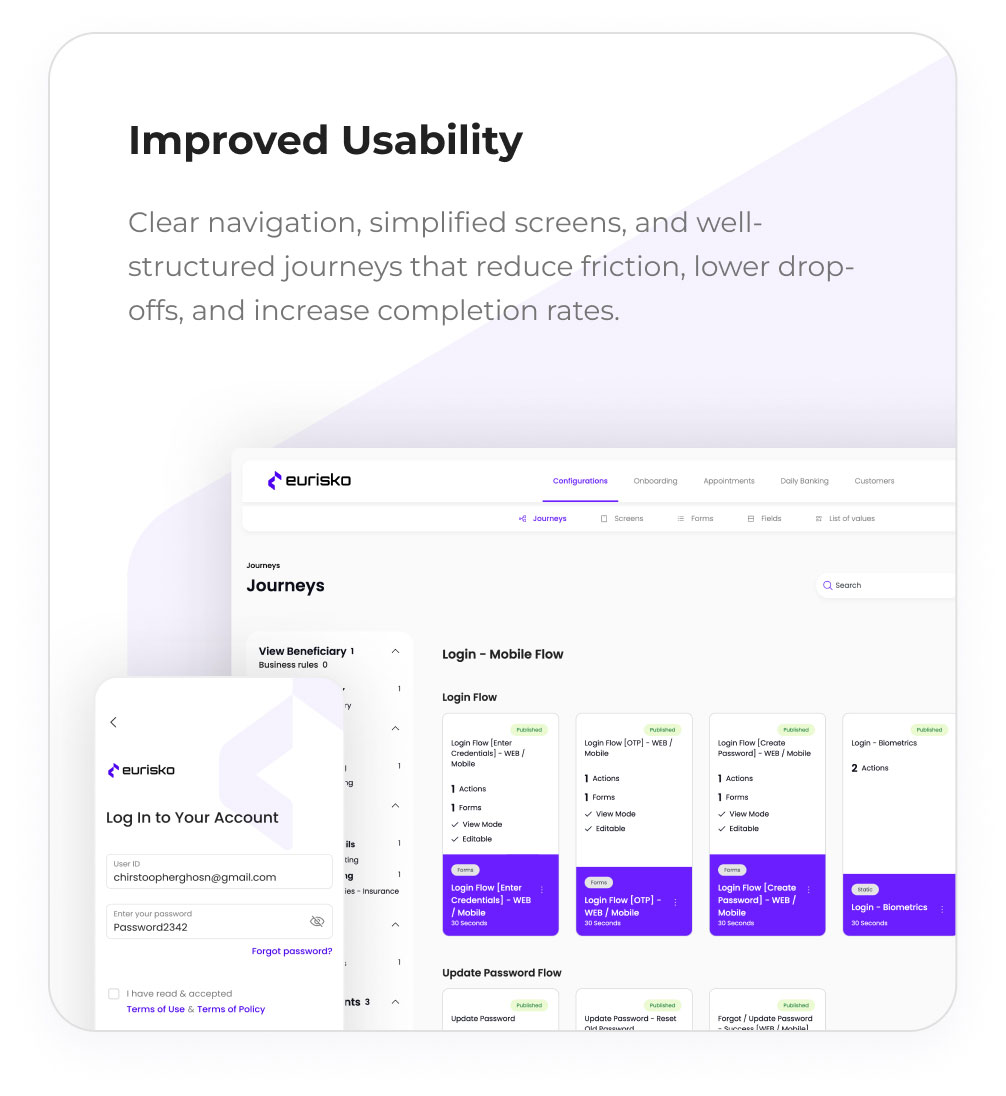

Unified Admin Portal

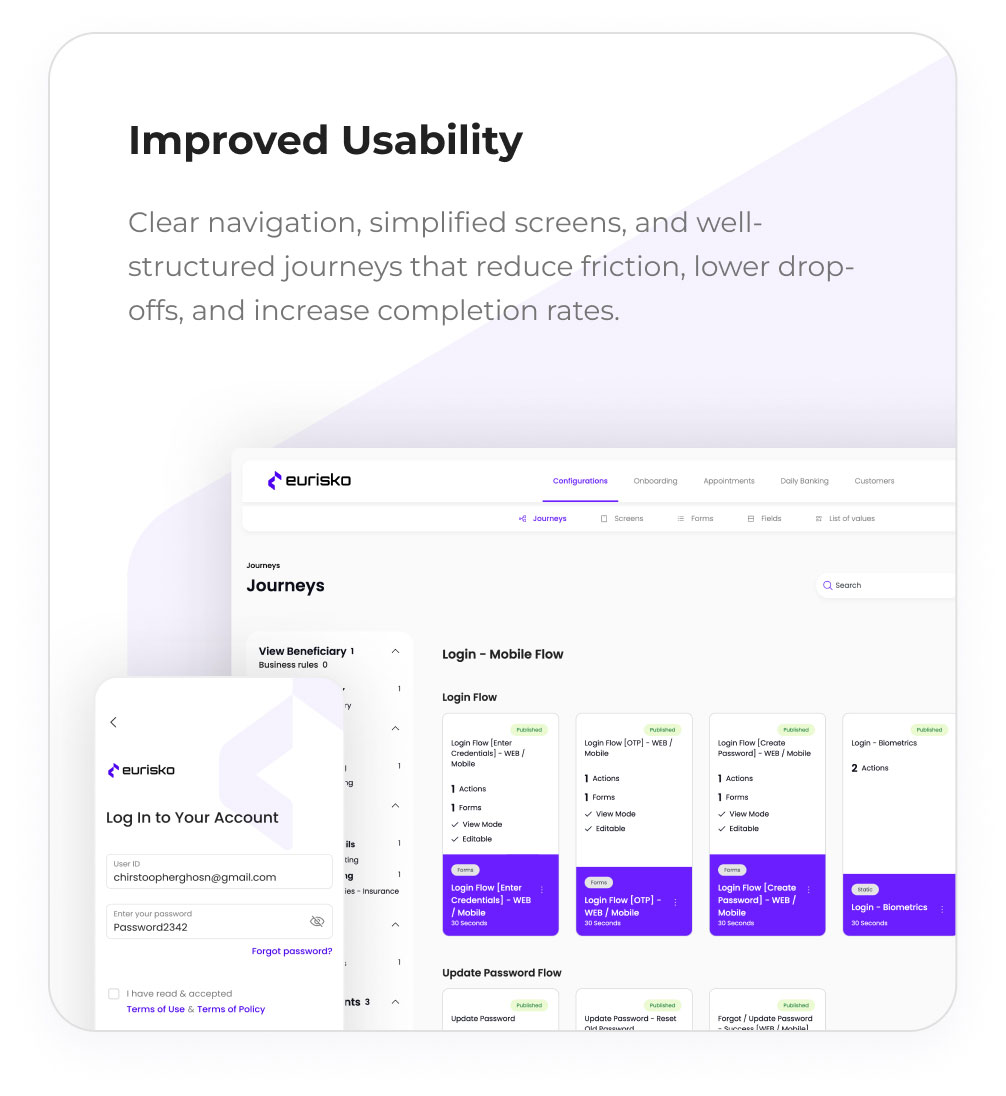

Configure flows, screens, rules, content, and localization instantly using a no-code to low-code platform. Give business and operations teams the power to update digital channels without developer involvement.

Infrastructure-Agnostic Deployment

Deploy in any environment (on-premise, private cloud, or public cloud) while maintaining full flexibility over your infrastructure strategy and data-residency requirements.

AI-Powered Experience

Enable conversational banking, smart segmentation, real-time recommendations, PFM (Personal Finance Management) insights, and intelligent automation. DXP is built AI-native, not AI-added, ensuring seamless integration across all journeys.

Key Benefits of Eurisko DXP

Banks today need a model that balances speed, ownership, and differentiation.

Faster Time-to-Market

Launch new digital banking journeys in weeks instead of months. Accelerate product rollout across Retail, SME, and Corporate channels with a composable, accelerator-driven foundation.

Full Ownership and Control

Manage journeys, business rules, content, UI components, and APIs independently, without relying on external vendors. Your team retains complete autonomy over every aspect of the digital experience.

Composable and Modular Architecture

Build once and reuse across all banking segments. Scale rapidly, launch new features faster, and evolve your digital channels continuously with a microservices-based, future-proof architecture.

Unified Admin Portal

Configure flows, screens, rules, content, and localization instantly using a no-code to low-code platform. Give business and operations teams the power to update digital channels without developer involvement.

Infrastructure-Agnostic Deployment

Deploy in any environment (on-premise, private cloud, or public cloud) while maintaining full flexibility over your infrastructure strategy and data-residency requirements.

AI-Powered Experience

Enable conversational banking, smart segmentation, real-time recommendations, PFM (Personal Finance Management) insights, and intelligent automation. DXP is built AI-native, not AI-added, ensuring seamless integration across all journeys.

Core Platform Capabilities

Eurisko empowers financial institutions to become smart financial partners for their customers instead of mere service providers

AI Capabilities Within Eurisko DXP

Eurisko empowers financial institutions to become smart financial partners for their customers instead of mere service providers

Core Platform Capabilities

Eurisko empowers financial institutions to become smart financial partners for their customers instead of mere service providers

Core Platform Capabilities

Eurisko empowers financial institutions to become smart financial partners for their customers instead of mere service providers

Built for All Banking Segments

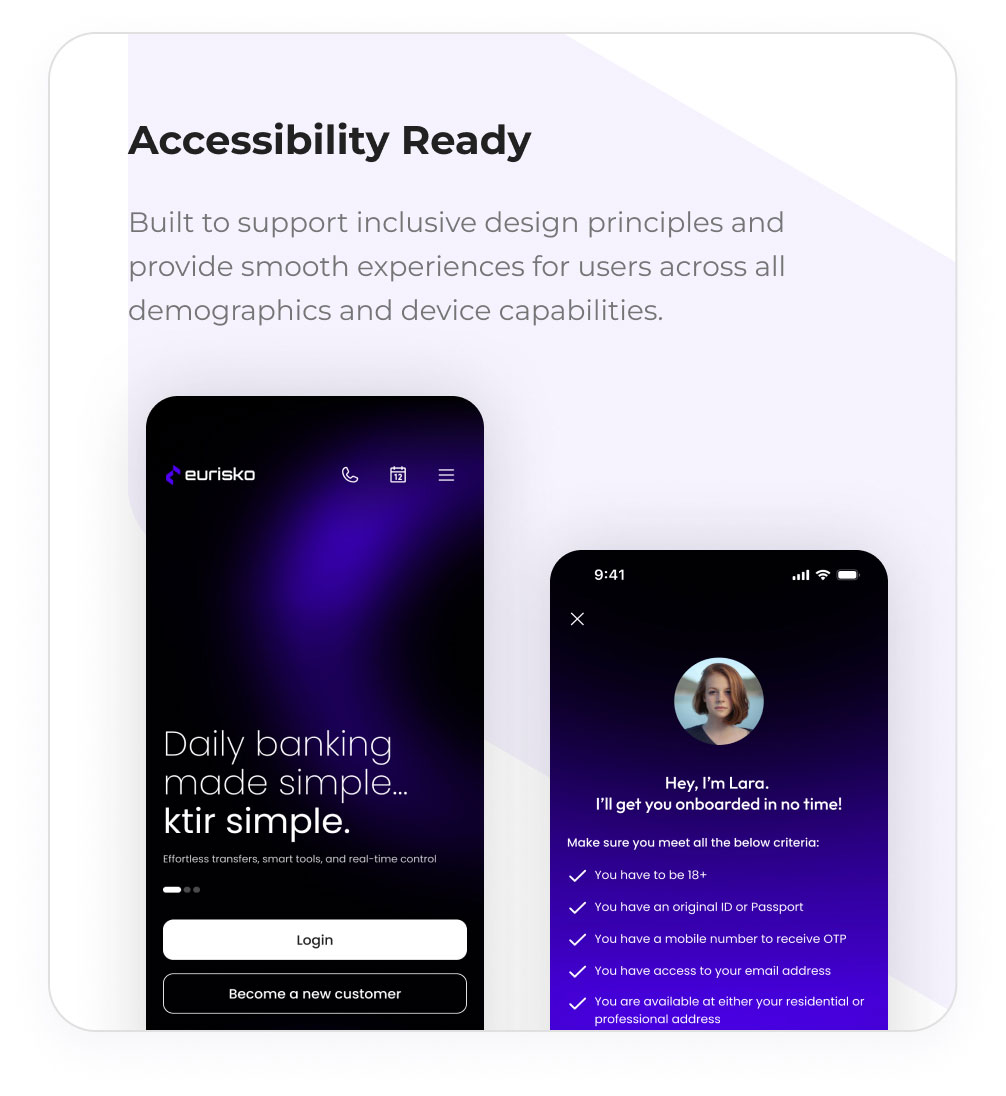

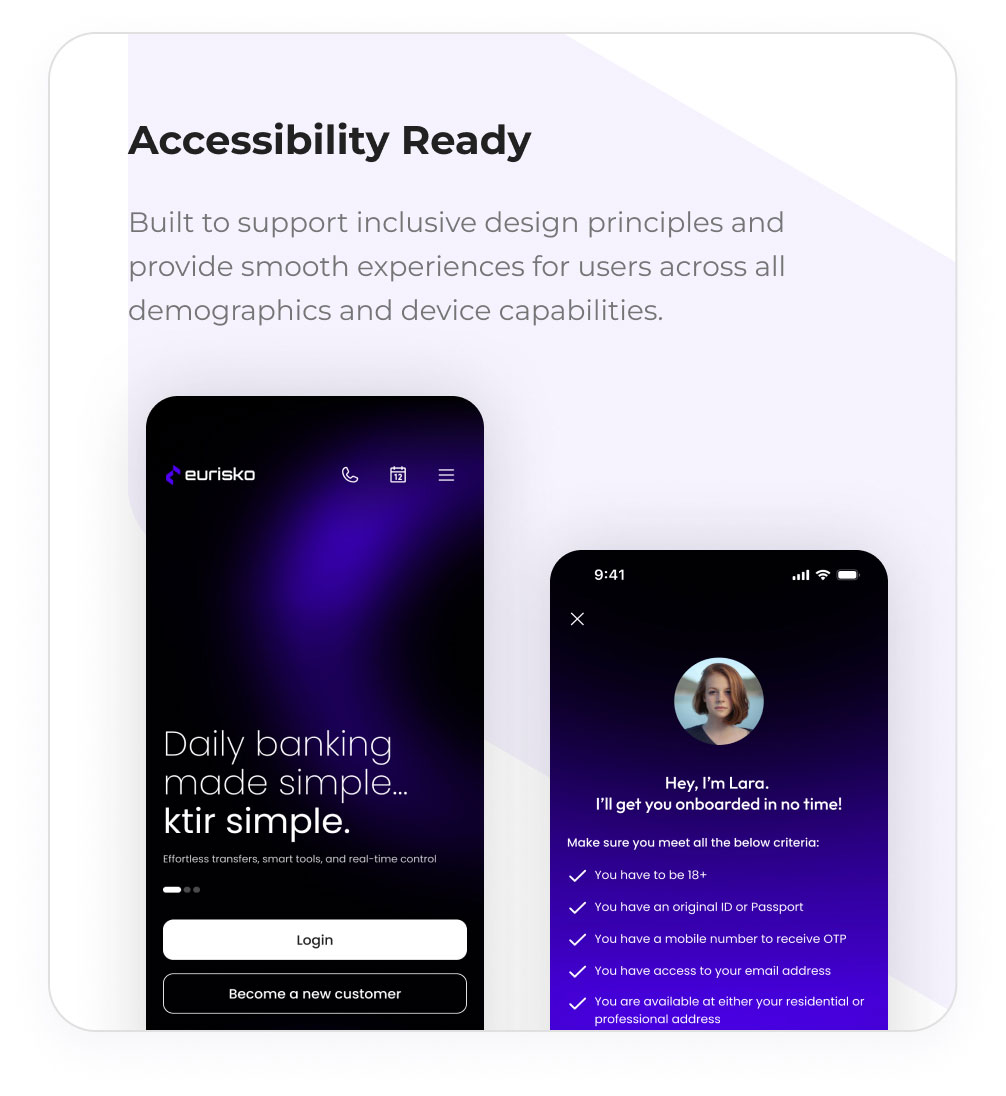

Eurisko DXP is designed to support the full spectrum of banking customers. The platform provides a unified foundation with shared components while allowing each segment to receive tailored capabilities and experiences.

Built for Every Leader

Eurisko DXP is designed to support every stakeholder within the bank. Each team gains the visibility, control, and tools needed to drive digital transformation with speed and confidence.

Management and Executives

Strategic visibility, faster time to market, and full ownership of the digital roadmap.

Technology and IT Teams

A microservices based, DevOps ready, API driven architecture designed for scalability, reliability, and continuous innovation.

Marketing and Operations Teams

A centralized data foundation that enables segmentation, targeting, omnichannel engagement, and performance optimization.

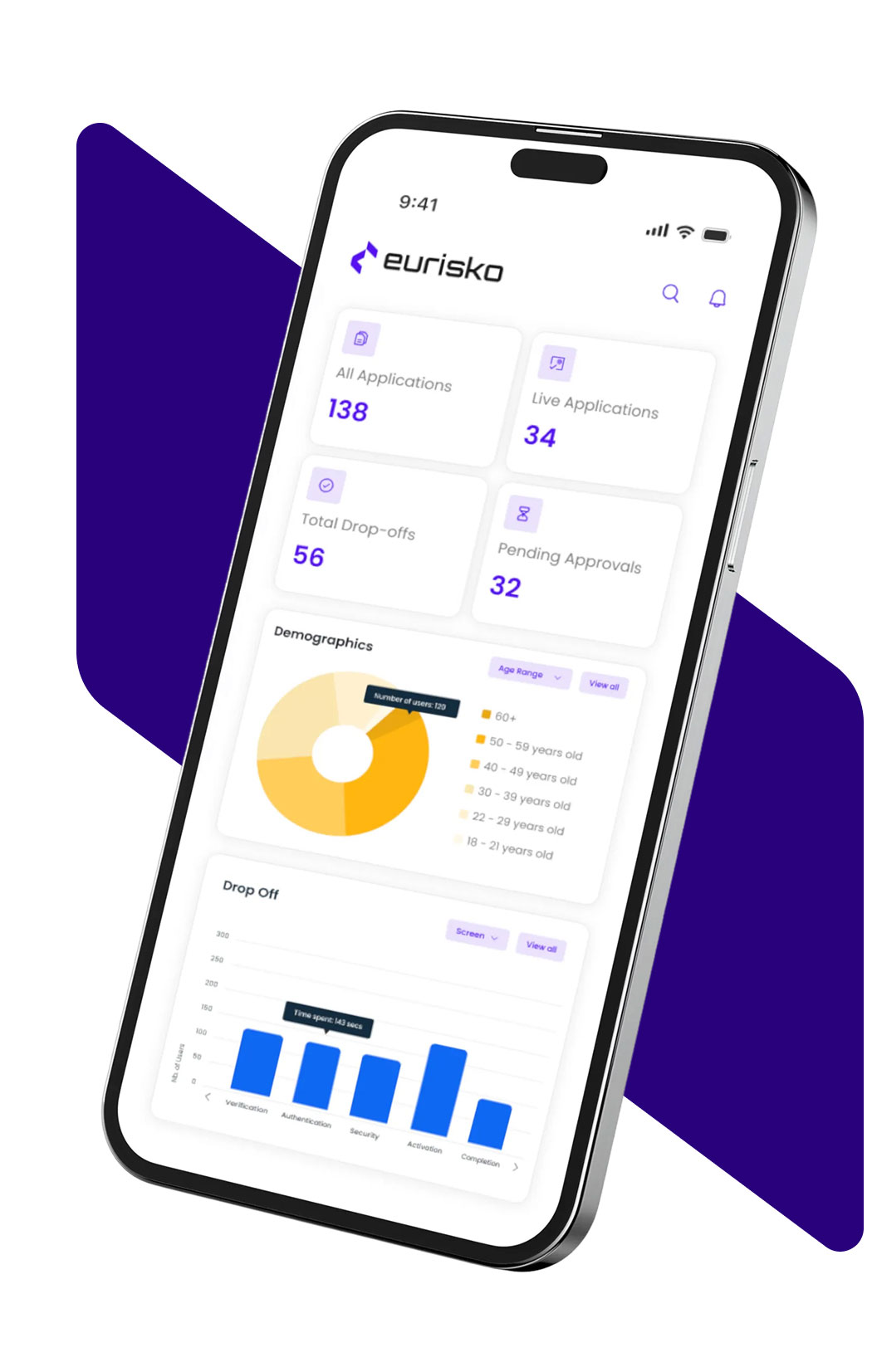

Data Teams (BI and BA)

A unified data layer that supports analytics, dashboards, predictive insights, modeling, and advanced reporting.

Compliance Officers

Built-in governance, audit trails, KYC and AML workflows, and alignment with regional and global regulatory frameworks.

AI in Action

From conversational banking assistants and smart knowledge bases to hyper-personalized recommendations, Eurisko DXP enables AI-driven engagement and operational efficiency. It transforms customer interactions into intelligent, real-time experiences.FAQs

Eurisko DXP is a composable, cloud-native digital banking platform that enables banks to design, deploy, and manage digital workflows across retail, SME, and corporate banking. It helps institutions accelerate innovation while maintaining full control, compliance, and security.

Unlike rigid out-of-the-box systems, Eurisko DXP follows a hybrid co-build model that combines the speed of pre-built accelerators with complete ownership of your roadmap. Banks can modify journeys, rules, and content instantly, without vendor lock-in.

Most banks launch pilot journeys in 6–8 weeks and achieve full-scale rollout within 3–6 months. The platform’s modular, DevOps-ready architecture shortens deployment time and supports continuous delivery.

Yes. Eurisko DXP includes a Connector Framework with pre-built integrations for core banking, KYC/AML, CRM, and payments. Its open APIs and microservices architecture make integration seamless and future-proof.

Eurisko DXP is designed for regulatory compliance and data protection. It supports PSD2, DIFC, SAMA, and Basel III frameworks while offering full encryption, data residency, and auditable KYC/AML workflows.