Rethinking The Finance Industry

Rise to modern customers’ expectations for speed, access, ease, and secure digital financial services.

Emerging technologies transform how modern consumers interact with financial institutions, manage their personal and business finances, and insurance and execute daily transactions.

Money now has a virtual aspect, affords virtual assets and items, and is part of a larger decentralized ecosystem.

Rethinking The Finance Industry

Rise to modern customers’ expectations for speed, access, ease, and secure digital financial services.

Emerging technologies transform how modern consumers interact with financial institutions, manage their personal and business finances, and insurance and execute daily transactions.

Money now has a virtual aspect, affords virtual assets and items, and is part of a larger decentralized ecosystem.

Trends Driving the Future of Fintech

Eurisko assists financial institutions in adopting a digital-first mindset

Trends Driving the Future of Fintech

Eurisko assists financial institutions in adopting a digital-first mindset

Next-Level Banking

Eurisko empowers financial institutions to become smart financial partners for their customers instead of mere service providers

AI/ML

Leverage predictive behavioral analytics, and data-driven marketing to eliminate the guesswork in financial decisions.

Gamification

Include gaming mechanics in banking apps to improve the financial intelligence, spending, and saving behaviors of customers.

Automation

Automate customer service by utilizing AI chatbots and AI interfaces to assist customers with basic tasks, queries, and complaints with no human intervention.

VR/AR

Improve the customer experience by presenting complex data in a visual-friendly way, creating virtual branches, facilitating payment for virtual shopping, and viewing the stock market and trade in real-time.

Apps in Fintech

Eurisko helps financial businesses ideate, design, and develop a wide range of financial apps, PWAs, and web portals for B2B and B2C solutions

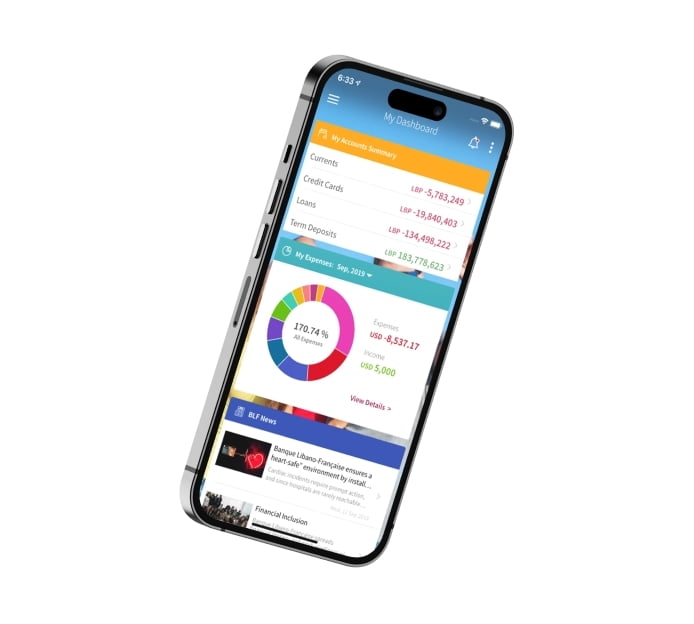

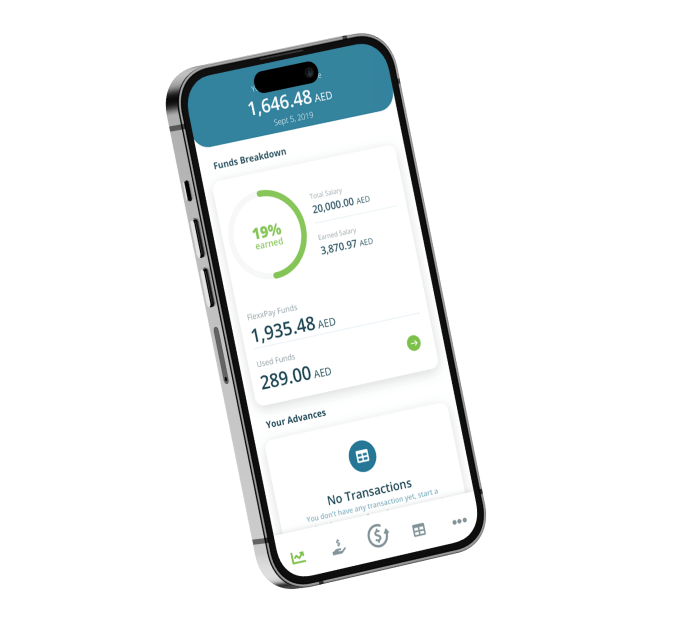

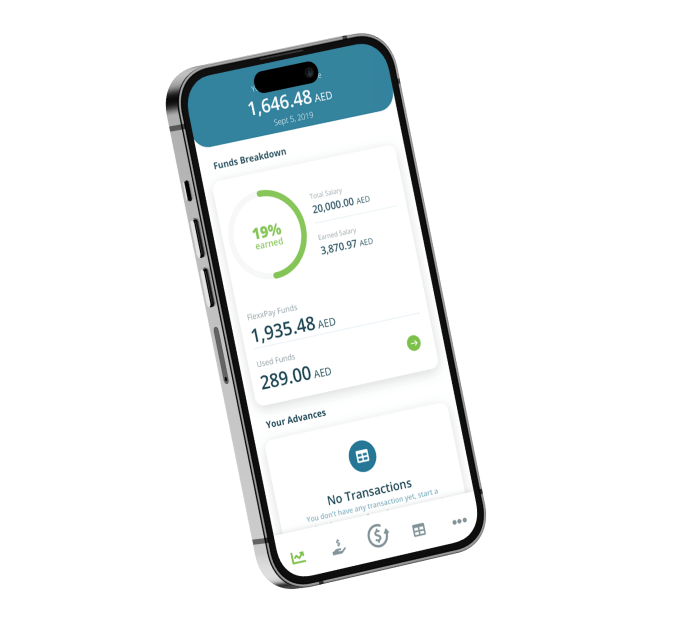

Personal Finance Apps

Individuals can manage their finances in one place: track their spending, saving, investing, transfers, and bill payments.

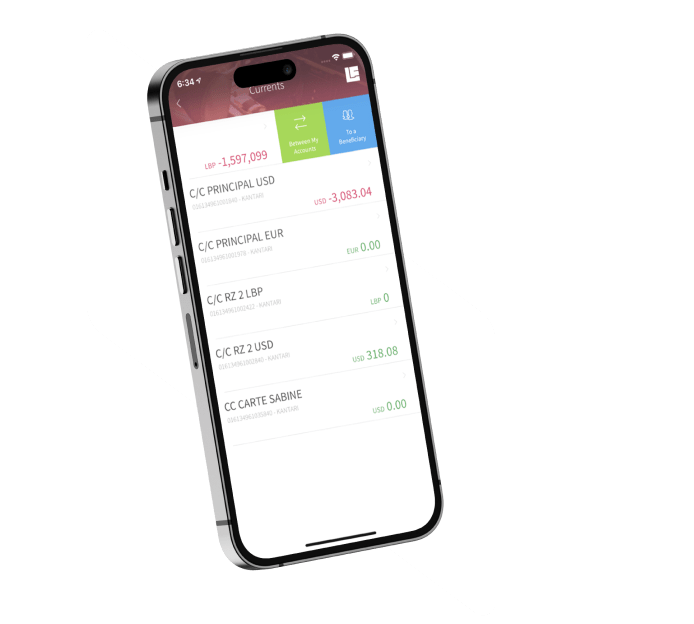

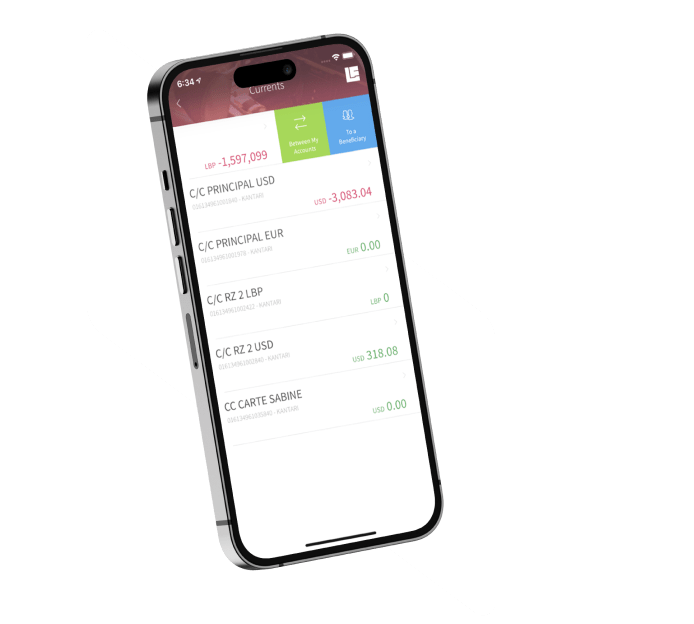

Online Banking Apps

Customers can monitor their banking accounts with a few clicks, and benefit from the self-service option.

Crypto Apps

Modern consumers can use crypto wallets to hold, manage and transact in cryptocurrencies and digital tokens.

Investment Apps

Traders can visually and easily sell and buy stocks, cryptocurrencies, commodities, etc. from their mobiles.

Peer-to-Peer Lending platforms

Individuals and startups can receive loans from an array of individuals who contribute microloans directly to them.

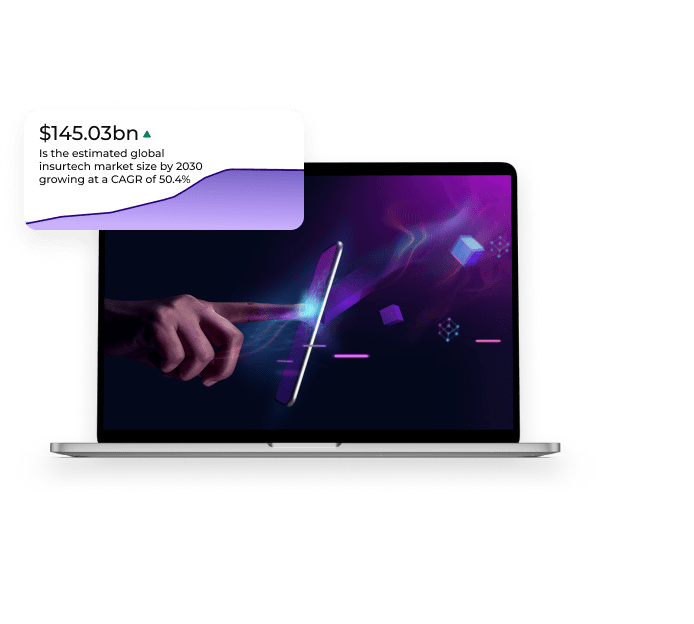

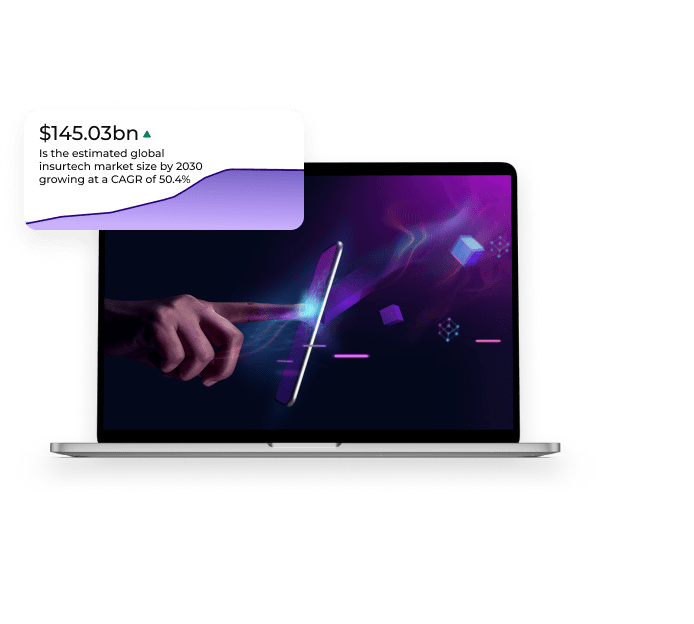

Insurtech

Insurers can manage their policies at their fingertip, and agencies can benefit from the auto adjustments of insurance rates.

Apps in Fintech

Eurisko helps financial businesses ideate, design, and develop a wide range of financial apps, PWAs, and web portals for B2B and B2C solutions

Personal Finance Apps

Individuals can manage their finances in one place: track their spending, saving, investing, transfers, and bill payments.

Online Banking Apps

Customers can monitor their banking accounts with a few clicks, and benefit from the self-service option.

Crypto Apps

Modern consumers can use crypto wallets to hold, manage and transact in cryptocurrencies and digital tokens.

Investment Apps

Traders can visually and easily sell and buy stocks, cryptocurrencies, commodities, etc. from their mobiles.

Peer-to-Peer Lending platforms

Individuals and startups can receive loans from an array of individuals who contribute microloans directly to them.

Insurtech

Insurers can manage their policies at their fingertip, and agencies can benefit from the auto adjustments of insurance rates.

Banking in the Metaverse

Metaverse Banking is the power of “Banking everywhere” with unlimited possibilities

Banking in the Metaverse

Metaverse Banking is the power of “Banking everywhere” with unlimited possibilities

The Role of Banks in the Metaverse

Trusted Custodians

Banks are more experienced in handling, preserving, and investing in people’s money, and so it is for their digital assets.

Virtual Wallets

Banks can be relied on to provide virtual wallets for people to store their cryptocurrencies, real money, and digital assets.

“Pay any way” Transactions

Banks can help develop the regulations, rules, and services that are needed for the safe, fast, and frictionless movement of digital assets.

A Bridge Between 2 Worlds

Banks can bridge the gaps between the real world and the metaverse by working on crypto-to-fiat exchanges and similar services.

The Role of Banks in the Metaverse

Trusted Custodians

Banks are more experienced in handling, preserving, and investing in people’s money, and so it is for their digital assets.

Virtual Wallets

Banks can be relied on to provide virtual wallets for people to store their cryptocurrencies, real money, and digital assets.

“Pay any way” Transactions

Banks can help develop the regulations, rules, and services that are needed for the safe, fast, and frictionless movement of digital assets.

A Bridge Between 2 Worlds

Banks can bridge the gaps between the real world and the metaverse by working on crypto-to-fiat exchanges and similar services.

Insurtech

Disrupting technologies help insurance companies improve their underwriting, claims processing, rates calculation, and assets management

Artificial Intelligence (AI)

Automate tasks and leverage customer self-service

Machine Learning (ML)

Collect user data, estimate premium amount, and predict demand

Smartphone Apps

Facilitate insurance quotation, purchase, and monitoring by policyholders

Blockchain

Improve data security standards while bringing down transaction expenses

Internet of Things (IoT)

Track car’s speed, analyze braking patterns or health risk patterns, detect location to predict safety and accident risk analysis

Data Analytics

Get deeper insights into customer needs and targeted products/services, process claims quickly, and customize marketing campaigns

Key Applications of Insurtech

Eurisko leverages cutting-edge technologies to take your insurance business to the next level

Know Your Customer (KYC) Process

Insurers can collect all counterparty information to verify identities using blockchain to store customer identification details from issuing authorities

Managing Claims

Insurers can use blockchain technology to create standardized claims document-evaluated by underwriters in real-time and automate smart contract elements, ensuring its execution is flexible and transparent.

Smart Contract Formulation

Insurers can register contracts, run authentications, and clear claims faster without an assessor, reducing the likelihood of fraud and increasing customer satisfaction.

Fraud Detection

Insurers can find and stop fraud with a decentralized digital depository by preventing duplicate transactions and third-party interference and making all transactions public record.

Payment Processing

Insurers can streamline premiums and claims, to draw payments for car insurance based on the miles driven, recorded, and calculated in real-time for a more accurate premium.

Key Applications of Insurtech

Eurisko leverages cutting-edge technologies to take your insurance business to the next level

Know Your Customer (KYC) Process

Insurers can collect all counterparty information to verify identities using blockchain to store customer identification details from issuing authorities

Managing Claims

Insurers can use blockchain technology to create standardized claims document-evaluated by underwriters in real-time and automate smart contract elements, ensuring its execution is flexible and transparent.

Smart Contract Formulation

Insurers can register contracts, run authentications, and clear claims faster without an assessor, reducing the likelihood of fraud and increasing customer satisfaction.

Fraud Detection

Insurers can find and stop fraud with a decentralized digital depository by preventing duplicate transactions and third-party interference and making all transactions public record.

Payment Processing

Insurers can streamline premiums and claims, to draw payments for car insurance based on the miles driven, recorded, and calculated in real-time for a more accurate premium.