Cybercrime costs the world economy around $600 billion annually, approximately 0.8% of the global GDP.

And with a Global non-cash transaction volume set to reach $1.3 trillion in 2023, online fraud statistics are becoming alarming.

Just this year, online shopping scams added up to more than $48 billion worldwide!

So, the big question is, how can AI (Artificial Intelligence) make our banks safer and stronger? That’s what we’re diving into in this blog

Table of Contents

Why AI has become crucial in the financial sector

The most common types of banking fraud

The role of AI in fraud detection

AI alignment with regulatory compliance

3 powerful ways conversational AI prevents fraud in banking and fintech

AI for safer and more convenient banking and fintech

Why has AI become crucial in The Financial Sector?

The financial sector connects all business and non-business sectors, for-profit and nonprofit, entities and individuals together.

What drives its evolution and technological adoption can be summarized by 3 key motivators:

- Delivering a better customer service

- Responding to external threats

- Creating new financial opportunities

Banks and Fintech companies have a moral obligation to move as fast as the technological wave and optimize their services and operations to be up to standards and customers’ needs.

The Digitization of Banking Products

Digitizing banking products resulted in a surge of new payment types such as instant payment and e-payments, and gave users access to online applications.

This pivotal move in financial transactions and consumer behavior improved the overall customer experience but resulted in a surge in fraud.

Banks and Fintech companies were pressured to recur to Machine Learning (ML) and Deep Learning (DL) to stay ahead of tech-savvy fraudsters.

Shift in Consumer Behavior

“We are moving into an era of frictionless, or intuitive, payments” – Mastercard.

Consumers are becoming fast and educated adopters. They require top-quality products, convenience, flexibility, and privacy.

In response, banks shifted their focus from keeping fraud low and limiting losses to providing the best consumer experience with the least amount of fraud thus introducing friction when it is absolutely necessary.”

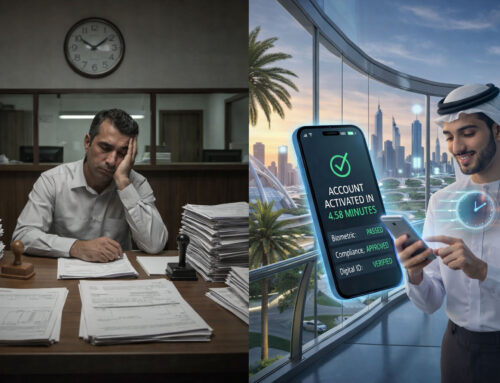

AI Fraud Detection vs Conventional Fraud Detection

Traditional fraud detection methods often rely on rule-based systems, using predefined rules to flag potentially fraudulent transactions.

While effective to some extent, these systems may need help to analyze vast amounts of data in real-time.

AI-based fraud detection relies on AI, especially machine learning, which excels in processing and analyzing massive datasets.

It can identify subtle patterns and anomalies by learning from historical transaction data, enabling more accurate and timely fraud detection.

| Traditional Fraud Detection | AI-Based Fraud Detection |

| Rule-based systems | Machine Learning and deep learning |

| Could become outdated as fraudsters develop new techniques | ML models continuously adapt to new fraud patterns |

| Requires manual updates to rules | ML models learn in real-time and automatically adjust their algorithms |

| May generate false positives or false negatives | AI models enhance accuracy by considering a multitude of factors. They reduce false positives |

| Latency issues, especially as transaction volumes increase. Challenging real-time fraud detection. | AI excels in real-time analysis, enabling swift identification of suspicious patterns and immediate response to potential fraud |

| N/A | Unsupervised learning within AI allows the system to identify patterns without predefined labels. This is particularly valuable for detecting novel fraud schemes that may not have been encountered before. |

McKinsey’s AI Playbook announces, “With AI-based software solutions, businesses have the potential to unlock up to $1 trillion in extra value!”

The Most Common Types of Banking Fraud

The types of banking Fraud are enumerable, and with new tech adoption comes new challenges every day.

Here are the most common types of banking fraud around the world.

Unauthorized Transactions

A Forbes article reported that roughly eight in 10 mobile banking users are concerned about credit card fraud.

Fraud prevention through AI: AI detects anomalies in the card owner’s spending patterns and flags them in real-time.

By building predictive models of the user’s future expenditure it immediately sends notifications in case of suspicious behavior.

The legitimate card owner can then block the card and contain damages.

AI-powered banking systems can also create ‘purchase profiles‘ for customers and identify transactions that deviate significantly from the usual.

Real-life application: Mastercard’s Decision Intelligence employs AI to analyze cardholder spending behavior (historical shopping), set a behavioral baseline against which it compares each new transaction, and evaluate the risk of fraud in real-time, enabling it to block suspicious transactions before they are authorized.

Phishing Scams

Both consumers and corporate employees can fall victim to phishing attacks leading to unauthorized transactions, account takeovers (ATO), data breaches, or identity theft.

Fraud prevention through AI: Machine learning (ML) algorithms can detect fraudulent activity in emails based on subject lines, content, and other details and label them as spam. This warns the user and reduces the danger of fraud.

Identity Theft

This type of fraud is the most common complaint among consumers.

In this case, cybercriminals steal a customer’s identity by hacking into their account and changing crucial account user credentials like passwords.

Fraud prevention through AI: Because AI recognizes the customer’s behavior patterns, it may detect unexpected activities such as password changes and contact information. To avoid identity theft, it warns the customer and employs measures such as multi-factor authentication.

Document Forgery

Here we talk about forged signatures, fake IDs, and fake credit card and loan applications which are common issues in banking.

Fraud prevention through AI: AI/ML algorithms learn the patterns of a signature and an ID, and detect minor flaws imperceptible to the human eye.

This is how banks can differentiate between original and fake identities, authenticate signatures, and detect forgeries with extremely high accuracy.

They can also reduce the possibility of someone cashing a cheque with a phoney ID.

Other useful tools could be multi-factor authentication and AI-backed KYC measures.

The Role of AI in Fraud Detection

AI brings a new dimension to fraud protection, employing advanced algorithms and machine learning to analyze vast datasets in real-time.

Here’s how AI can detect Fraud and prevent it:

Pattern Recognition: The Power of Anomalies

AI excels in recognizing patterns and identifying anomalies within vast datasets.

By establishing a baseline of normal user behavior, AI algorithms can swiftly detect deviations that may signal fraudulent activity.

This dynamic approach enables banks to stay one step ahead of fraudsters who continually refine their tactics.

Behavioral Biometrics: Unmasking the Fraudsters

In addition to standard security measures, AI uses biometrics based on behavior to verify users.

To confirm a user’s authenticity, factors like typing patterns, mouse motions, and even the unique cadence of voice can be analyzed.

This not only adds an additional layer of security but also ensures a smooth and user-friendly experience.

Predictive Analytics: Anticipating Fraudulent Moves

AI doesn’t just react to known threats; it anticipates them.

Through predictive analytics, AI models assess historical data to forecast potential fraud trends.

This proactive approach allows banks to implement preemptive measures, protecting both their assets and the trust of their customers.

Real-time Monitoring: The Need for Speed

Fraud doesn’t wait, and neither should protection measures.

AI enables real-time monitoring of transactions, swiftly identifying suspicious activities as they occur.

This rapid response time is crucial in mitigating potential losses and preventing fraudulent transactions from being completed.

Case Study: Danske Bank

Danske Bank is a Nordic universal bank, though it has 145 years of experience in the market, its fraud detection rate was as low as 40%.

Out of 1,200 false positives per day, 99.5% of all cases the bank was investigating were not fraud-related.

To put an end to these dead ends, the Bank decided to strategically apply innovative analytic techniques, including AI, to better identify instances of fraud while reducing false positives.

The results speak for themselves:

- A 60% reduction in false positives, with an expectation to reach as high as 80%.

- A 50% increase in true positives.

- Focus resources on actual cases of fraud.

AI Alignment with Regulatory Compliance

The General Data Protection Regulation (GDPR) stands as a cornerstone for safeguarding customer data privacy.

AI, with its ability to analyze and process vast datasets, aids financial institutions in adhering to GDPR by implementing robust data protection measures.

Through advanced encryption algorithms and anonymization techniques, AI systems contribute to the secure handling of sensitive information, aligning with GDPR’s principles of lawful and transparent data processing.

Moreover, the Payment Card Industry Data Security Standard (PCI DSS) imposes strict guidelines on the protection of payment card data.

Financial institutions leverage AI-powered fraud detection systems to meticulously scrutinize transactions in real time, identifying anomalies and potential threats to cardholder information.

By employing machine learning algorithms, these systems continuously evolve to recognize new patterns of fraudulent activities, thereby ensuring ongoing compliance with PCI DSS requirements.

The adaptive nature of AI not only fortifies defenses against unauthorized access but also positions financial institutions to proactively address emerging challenges, a crucial aspect in meeting the ever-evolving landscape of regulatory expectations.

3 Powerful Ways Conversational AI Prevents Fraud in Banking and Fintech

Talking to your customers is crucial to preventing fraud.

Any person may break their behavioral patterns for any reason; Financial institutions certainly don’t want to cancel a legitimate transaction.

Conversational AI can make these checks fully automatic, which is the perfect balance between being strict about stopping fraud and making things easy for customers.

Conversational AI for Transaction Verification

Conversational AI allows an automated system to respond in real-time to human speech, resulting in dynamic, lifelike discussions.

This achieves two critical goals for fraud detection:

- Increasing consumer trust in your voicebot.

- Enabling voicebots to collect the data required by their systems to validate legitimate transactions and invalidate fraudulent ones.

This transition to voice-based verification makes push notifications more accessible and convenient for all users.

Voice AI to Prevent Voice Phishing Attacks

In voice phishing scams, fraudsters call your customers, often using poor-quality TTS voices to automate the attempt.

They may claim to represent you to get personal information they can use to drain account credentials.

This is a serious challenge to banks because their systems aren’t involved in the scam. You can’t control them!

Thus, the key to preventing phishing is to give customers the power to authenticate you.

How can customers authenticate their banks’ representatives?

By presenting a single, unmistakable voice for your brand: a fully custom-built branded TTS voice, also known as a custom voice, unique to your institution, built on neural networks that produce warm, lifelike speech.

Voice AI also helps banks and fintech to authenticate the people they serve.

Voice Biometrics for User Authentication

Voice authentication is a new form of biometrics that can prevent identity theft in voice-based interactions between banks and consumers.

By using AI it identifies a speaker’s voice as belonging to them and only them, as it has more than 100 unique identifiers contained within the human voice.

However, these speech biometrics systems must also guide users through the log-in process, which necessitates the usage of voice output.

A recognized bespoke branded voice provides consumers with the confidence they require to accept this new verification approach.

AI For Safer and More Convenient Banking and Fintech

AI is establishing a new era of convenience and security for financial institutions and consumers alike.

By embracing the power of artificial intelligence in all its aspects banks, fintech and consumers can ensure accurate data analysis, prompt response, secure transactions, and unwavering fraud prevention.