Banks need speed without losing control, governance, or ownership

Yet many SME and corporate digital banking platforms are slow to launch, difficult to configure, and built on rigid structures that fail to reflect how real businesses operate.

Eurisko’s SME and Corporate Digital Banking platform enables banks to launch, manage, and scale business digital experiences with confidence. Built on Eurisko DXP, it mirrors real corporate workflows through configurable journeys, approval structures, and role-based access.

Deployment-agnostic by design, the platform supports on-premise, cloud, and hybrid environments, giving banks long-term flexibility, regulatory alignment, and full control over their digital evolution.

Industry Pain Points in SME and Corporate Banking

Banks offering SME and corporate digital banking face challenges that limit speed, control, and adoption.

Three Approaches to Building SME and Corporate Digital Banking

A side-by-side comparison of the most common models banks use to build, scale, and operate SME and corporate digital banking platforms.

| Category | Traditional Platforms | In-House Development | Eurisko Hybrid Model |

|---|---|---|---|

| Speed to Launch | Long rollout cycles for SME and corporate features | Multi year development before launch readiness | Faster launch using ready foundations and co build delivery |

| Journey Adaptability | Fixed workflows with limited flexibility | High flexibility with slow change cycles | Configurable journeys that can be adjusted quickly |

| Control & Ownership | Platform direction controlled by the vendor | Full control with high operational cost | Bank owns journeys, rules, content, and integrations |

| Scalability Model | Rigid systems that limit growth | Scales with significant internal engineering effort | Modular architecture built for SME and corporate growth |

| Deployment Options | Limited to predefined environments | Fully managed internally | Cloud, hybrid, or on premise deployment |

| User Experience Quality | Generic interfaces designed for broad use | Depends on internal UX capabilities | Modern and consistent UX designed for business users |

| Innovation Pace | Driven by vendor release schedules | Limited by internal capacity | Faster experimentation with continuous delivery |

| Cost Structure | Lower entry cost with rising long term fees | High upfront and ongoing investment | Balanced cost with long term autonomy |

| Operational Independence | Ongoing dependency on the vendor | High internal maintenance overhead | Bank manages and evolves the platform independently |

Control That Mirrors Real Business Workflows

Company structures reflected inside the platform

Businesses can operate using their real structure, including departments and user roles. The digital banking experience matches how companies work day to day.

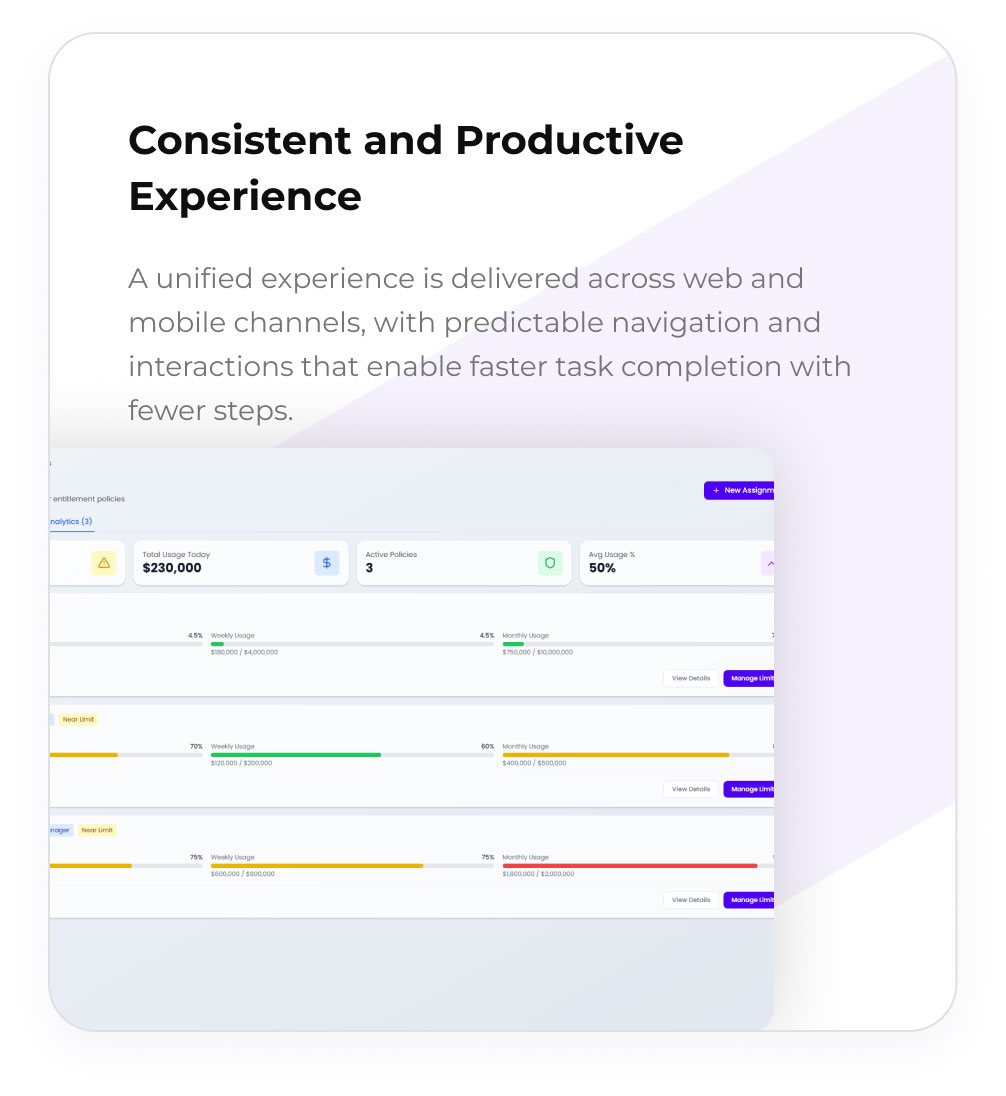

Clear user permissions and transaction limits

Banks can define what each user is allowed to do and how much they can transact. Limits can be applied across accounts, payment types, and services.

Approval rules that match business workflows

Transactions can require one or more approvals based on amount, type, or user role. Every action follows the correct approval path before execution.

The Eurisko Advantage for SME and Corporate Banking

Eurisko blends the speed of pre-built accelerators with the freedom of custom development.

Through a hybrid co-build delivery model, your teams work side-by-side with Eurisko experts to build digital banking journeys faster; while gaining full ownership of rules, content, APIs, and future enhancements.

Built for speed without compromise

Launch SME and corporate banking services faster while avoiding long build cycles or vendor led delays, and adapt journeys quickly as business needs change.

Faster Time to Market for SME and Corporate Banking

The platform enables banks to move from concept to launch in as little as six months, without sacrificing control, governance, or regulatory alignment.

Designed for control and autonomy

Banks retain full ownership of digital journeys, rules, and configurations, with no dependency on fixed vendor roadmaps and complete freedom to evolve at their own pace.

Powered by Eurisko DXP

Powered by Eurisko DXP, multi-step journeys can be configured without rebuilding systems, enabling banks to adjust screens, flows, and business logic independently, without returning to Eurisko for every change, while reusing components across SME and corporate use cases.

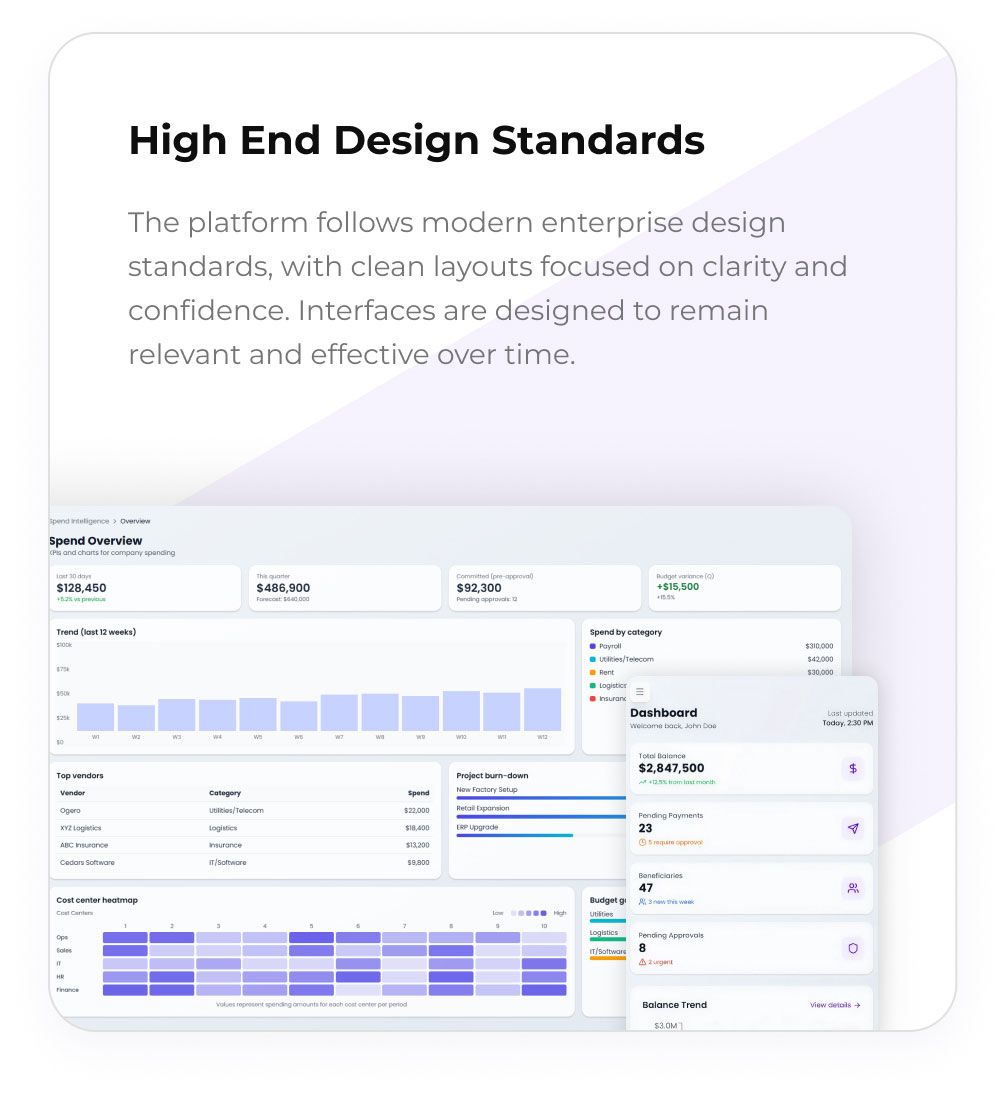

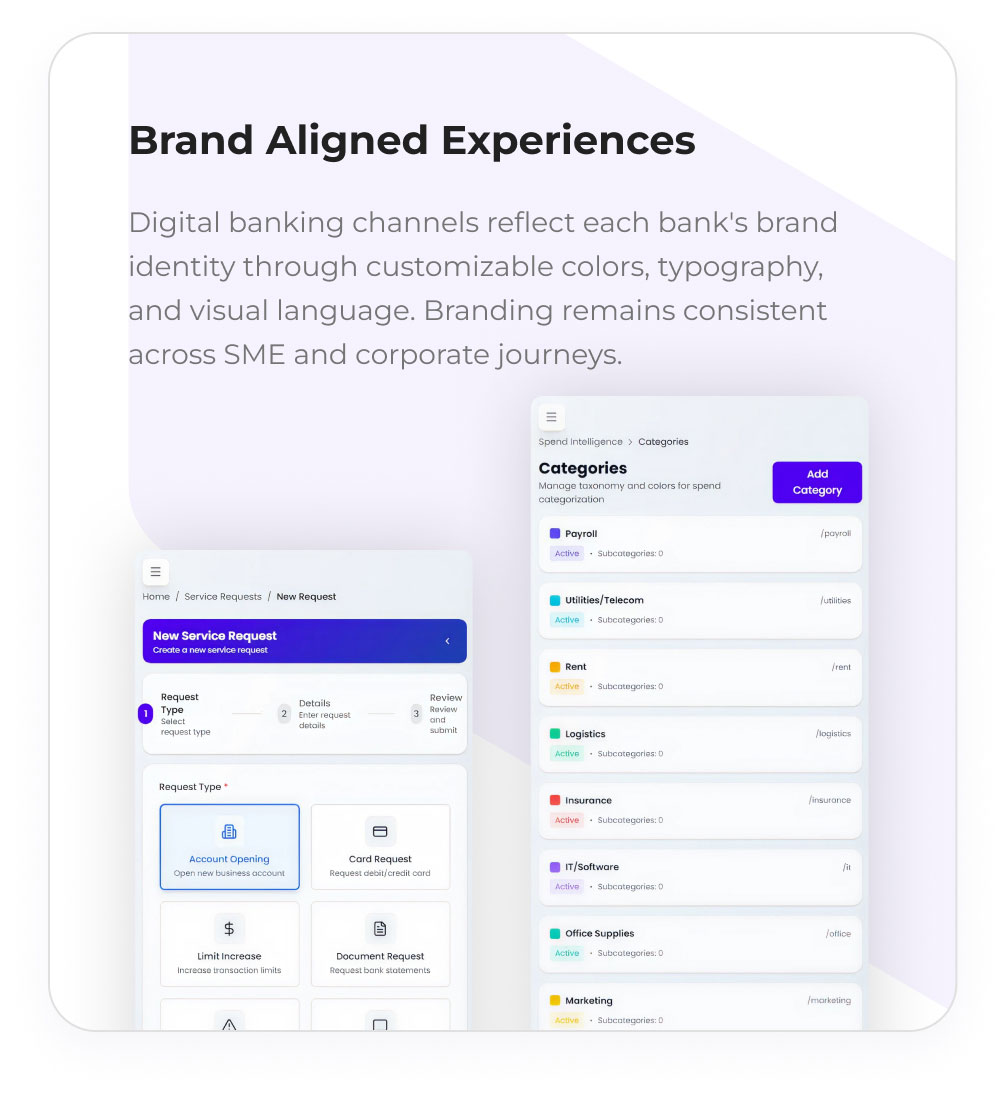

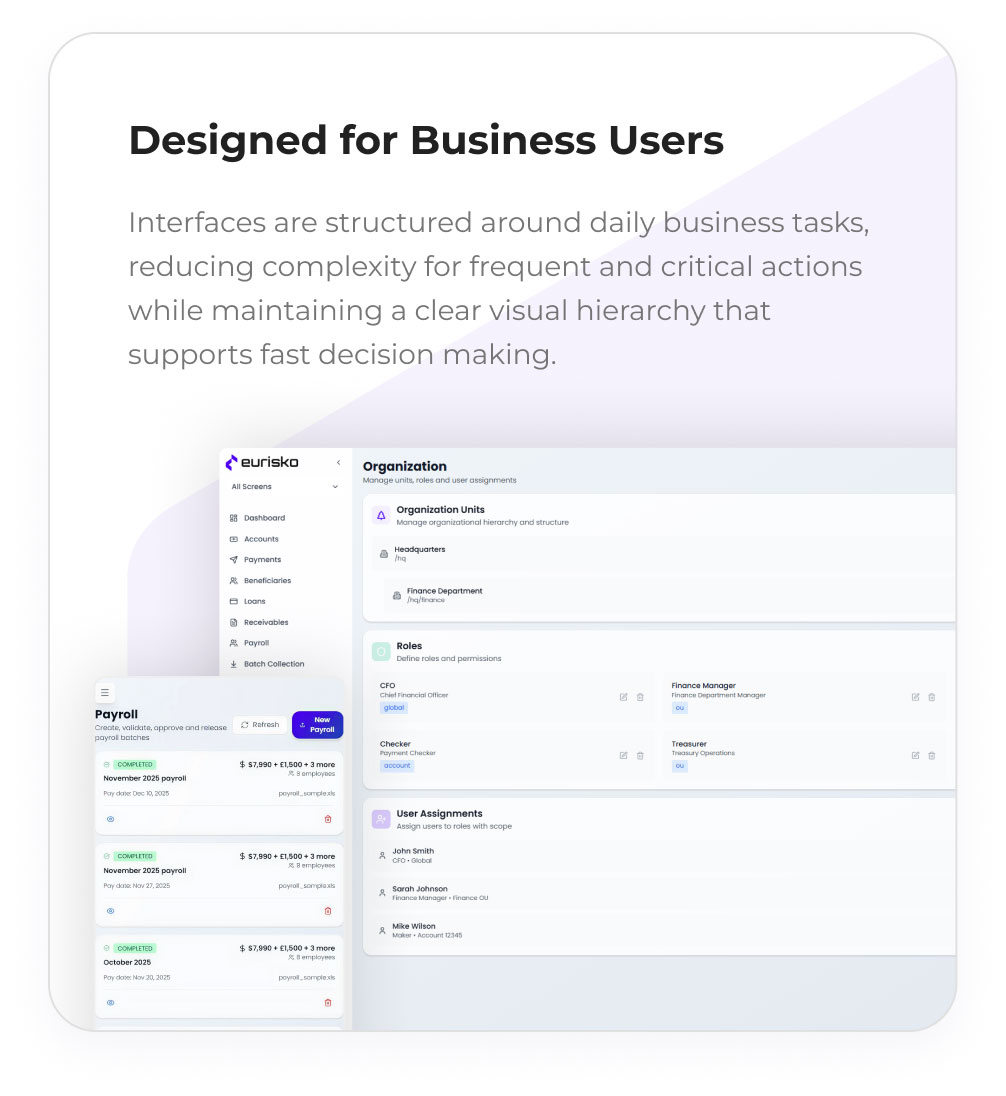

Modern experience for business users

Clean and intuitive interfaces support daily business operations, with role based views that reduce complexity and a consistent experience across web and mobile channels.

Flexible by architecture

The platform supports cloud, hybrid, or on premise deployment, integrates with core banking and third party systems, and scales from growing SMEs to complex corporate structures.

Key Benefits for Banks and Business Clients

Journey Management and Workflow Orchestration

DXP powered journeys and modular banking services: Eurisko DXP powers all multi step journeys, approvals, and workflows, while dashboards, reporting, and real time views are delivered through dedicated service modules for performance and scale.

Banks can configure multi-step journeys for onboarding, service requests, and applications, adapt flows, fields, and rules without rebuilding the platform, and apply approvals and validations consistently across every journey.

Payments and collections

The platform supports domestic and international transfers, bulk payments and standing orders, as well as receivables and batch collection designed for SME and corporate business use cases.

Batch collection for SME and corporate banking

Batch collection enables businesses to request and collect payments from multiple entities through structured uploads and approval workflows, supporting distributor and multi outlet models.

Controlled beneficiary management for SME and corporate banking

Beneficiary management is governed through structured creation flows, categorization, and approval rules. Banks can apply whitelist and blacklist policies to reduce risk while keeping payment operations efficient.

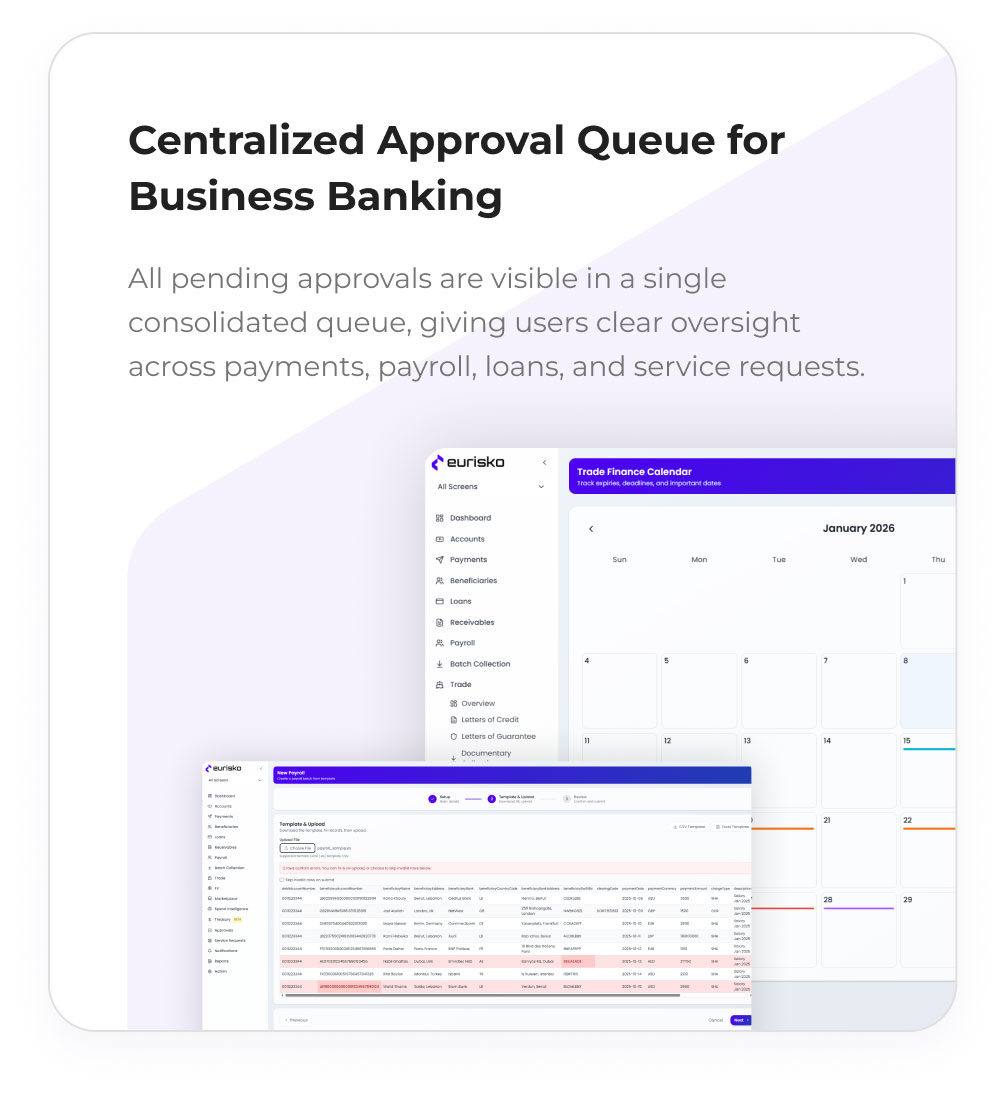

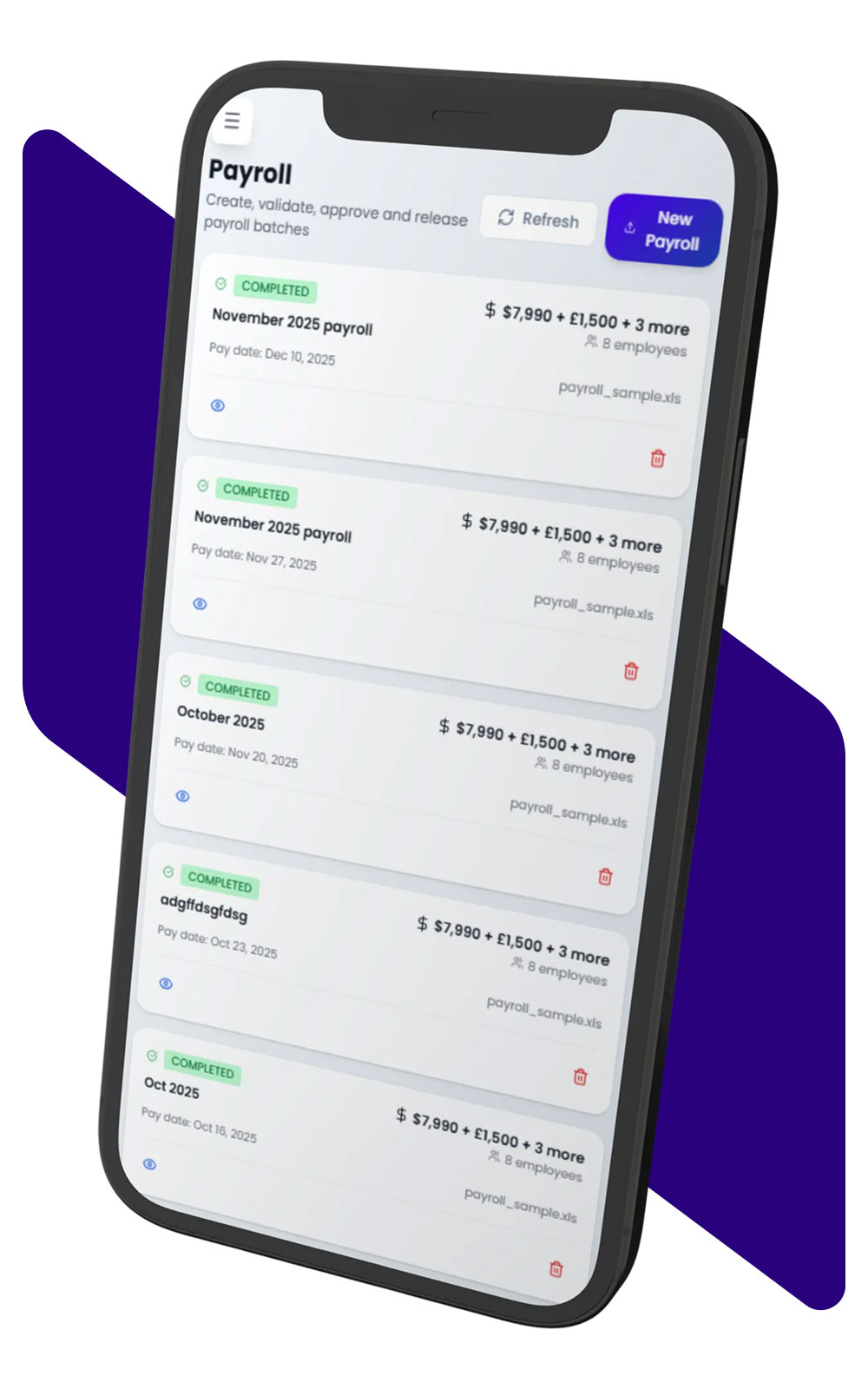

Payroll and Bulk Transactions

Banks can enable payroll and bulk payment file uploads with built-in validation, route batches through defined approval workflows, and execute payments only after all approvals are completed. Validation is dynamic and configurable (per bank/tenant/product/file type) and enforced in a two-stage model (frontend + backend) for maximum control and zero bypass.

Lending, Marketplace, and Trade Finance

AI Powered Digital Banking Intelligence

Eurisko’s SME Banking Platform is natively built for AI, with an architecture that supports intelligent insights, conversational experiences, and automation as plug-in capabilities from day one. This future-ready foundation lets banks roll out new AI features continuously, without disrupting operations, while maintaining security, compliance, and seamless integration with core systems.

Engineered for Security & Scalability

Banks today need a model that balances speed, ownership, and differentiation.

Built for High Performance

The platform supports high volumes of users and transactions while maintaining consistent performance, even during peak usage, ensuring reliability across critical business operations.

Scalable by Design

The architecture scales as SME and corporate usage grows, handling increasing transaction volume and complexity while supporting long term platform growth without disruption.

Integration Ready

The platform connects seamlessly with core banking systems and integrates with third party services and partners, enabling efficient and secure data exchange across the banking ecosystem.

Operational Resilience

System availability and fault tolerance are built in, supporting continuous operation and recovery mechanisms that reduce operational risk across all digital channels.

Engineered for Security & Scalability

Banks today need a model that balances speed, ownership, and differentiation.

Built for High Performance

The platform supports high volumes of users and transactions while maintaining consistent performance, even during peak usage, ensuring reliability across critical business operations.

Scalable by Design

The architecture scales as SME and corporate usage grows, handling increasing transaction volume and complexity while supporting long term platform growth without disruption.

Integration Ready

The platform connects seamlessly with core banking systems and integrates with third party services and partners, enabling efficient and secure data exchange across the banking ecosystem.

Operational Resilience

System availability and fault tolerance are built in, supporting continuous operation and recovery mechanisms that reduce operational risk across all digital channels.

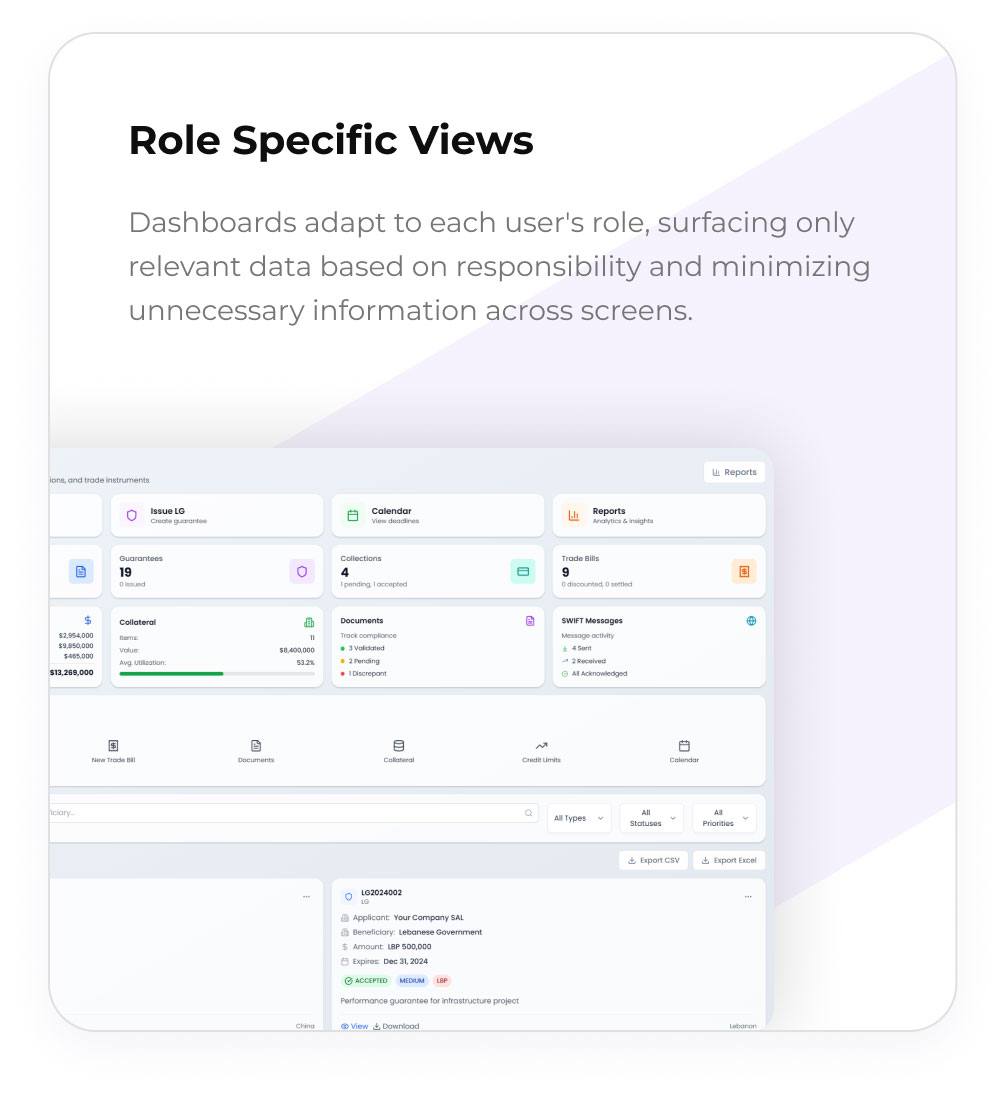

UI and UX Differentiation

Purposefully designed interfaces that adapt to user roles, simplify complex tasks, and deliver a consistent, productive experience across channels.

Built for Every Stakeholder

A unified SME banking platform designed to give every stakeholder the right level of control, visibility, and insight, without friction.

Banks

Banks gain full visibility and control over SME and corporate digital services, with the ability to configure journeys, rules, and governance centrally while maintaining ownership of the digital roadmap.

SME Administrators

Business administrators can manage users, roles, and approval structures, control limits and permissions, and adapt configurations easily as the organization evolves.

Finance and Treasury Teams

Finance teams can execute payments, payroll, and collections efficiently, monitor cash flow and spending activity, and operate within clearly defined governance frameworks.

Executives and Decision Makers

Senior leaders can access high level insights and reporting, maintain oversight without day to day operational involvement, and make informed decisions with confidence.

AI in Action

From conversational banking assistants and smart knowledge bases to hyper-personalized recommendations, Eurisko DXP enables AI-driven engagement and operational efficiency. It transforms customer interactions into intelligent, real-time experiences.FAQs

Eurisko’s SME banking platform helps banks launch and scale SME and corporate digital banking with configurable journeys, role-based access, and approval workflows that mirror real business operations.

Banks can move from discovery to full rollout in as little as 3–6 months, with pilot journeys typically delivered in the early rollout phase.

It supports role-based permissions, transaction limits & entitlement policies, and approval rules that route actions through one or more approvers based on amount, type, or role before execution.

Yes. Banks can enable payroll and bulk file uploads with built-in validation and approval workflows, with a two-stage validation model (frontend + backend) to prevent bypass.

It supports domestic and international transfers, bulk payments, standing orders, receivables, and batch collection designed for SME and corporate use cases.

Yes. SMEs can initiate LC/guarantee/collection and financing requests from a single hub, upload documents, track milestones and limits, and route cases through compliance checks and approvals.

It’s deployment-agnostic and supports cloud, hybrid, and on-premise environments to align with regulatory and operational needs.

The platform, powered by Eurisko DXP is designed to integrate with core banking and third-party services via an integration-ready architecture and connector approach for banking ecosystems.